myyalta.ru

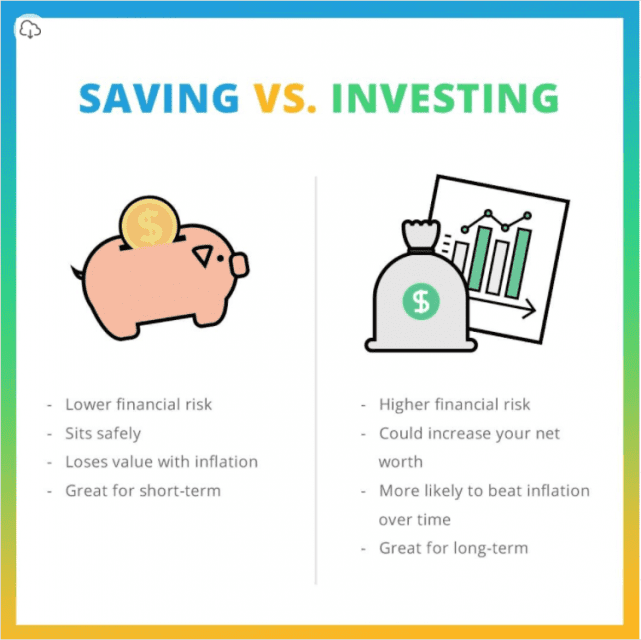

Market

Best Savings Investment

A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you. CDs, money market accounts, and traditional savings accounts are best served for short-term goals. Investing is generally reserved for long-term goals so. 1. Build an emergency fund · LendingClub LevelUp Savings Account · UFB Portfolio Savings · Marcus by Goldman Sachs High Yield Online Savings. PPF, NPS, Post Office Savings Scheme, Bank and Company FDs, SCSS, RBI Taxable Bonds, and Traditional Life insurance plans all fall under the low-risk category. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Build the saving and investing skills that will carry a child through life. Get started today with a Fidelity account and start saving for your child or. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. Earn potentially higher yields, preserve principal, and get easy access to funds. Savings and investment cash options. CERTIFICATES OF DEPOSIT (CDs). %. What to invest in right now · 5. High-yield savings accounts. Savings accounts offered by branch-based banks are notorious for paying minuscule interest rates. A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you. CDs, money market accounts, and traditional savings accounts are best served for short-term goals. Investing is generally reserved for long-term goals so. 1. Build an emergency fund · LendingClub LevelUp Savings Account · UFB Portfolio Savings · Marcus by Goldman Sachs High Yield Online Savings. PPF, NPS, Post Office Savings Scheme, Bank and Company FDs, SCSS, RBI Taxable Bonds, and Traditional Life insurance plans all fall under the low-risk category. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Build the saving and investing skills that will carry a child through life. Get started today with a Fidelity account and start saving for your child or. Keep cash for goals you want to achieve within the next two years in a low-risk account, such as a high-yield savings account that earns at least 3% interest. Earn potentially higher yields, preserve principal, and get easy access to funds. Savings and investment cash options. CERTIFICATES OF DEPOSIT (CDs). %. What to invest in right now · 5. High-yield savings accounts. Savings accounts offered by branch-based banks are notorious for paying minuscule interest rates.

9 Best Safe Investments · High-yield savings accounts · Certificates of deposit · Money market accounts · Treasury bonds · Treasury Inflation-Protected Securities. Savings platform Raisin and Cahoot bank are currently tied for the best-payin easy-access savings account in the UK at %. So, based on the minimum deposit. When would a savings account be the best investment to earn interest? Savings accounts offer a suite of benefits to savers. Ease of use, high accessibility. saving and investing. For short term goals, a savings account remains the best way to maintain access to your cash. You can add to your savings in one-off. The best place for most people is a money market fund because (a) they have higher yield than nearly all savings accounts and (b) they have potential tax. Start saving, form a savings habit, and pay yourself first! · Open and keep an account at a bank or credit union that meets your needs. · Track your savings and. savings strategy. Learn More. Spryng. An Investors should carefully consider plan investment goals, risks, charges and expenses before investing. Low-risk investments. These include Treasury and other government bonds. Yields on these kinds of investments vary and can be higher than what's available with. 1. Bank savings accounts tend to pay some of the lowest interest rates compared to other types of investments, however your money in these accounts is. Understanding investment types. Are you getting the best possible returns on your short-term savings? Published February 16, Learn how Vanguard can help. Actions You Can Take · Start saving, form a savings habit, and pay yourself first! · Open and keep an account at a bank or credit union that meets your needs. Best Investment Account for Kids: 5 Options · 1. Custodial Roth IRA · 2. Education Savings Plans · 3. Coverdell Education Savings Accounts · 4. UGMA/UTMA. Investments typically have the potential for higher return than a savings account. Learn about investment types. You are here: Saving 2 of 2: Investing. One of the safest and easiest short-term investment options is a high-yield savings account. They work the same as a standard savings account. You deposit money. Some examples would include automatic saving, saving coins, banking savings on coupons or refunds. Just think about what works best for you. One suggestion. 5 types of low-risk investments · 1. Treasury bills, Treasury notes and TIPs · 2. Fixed annuities · 3. Money market funds · 4. Corporate bonds · 5. Series I savings. your savings or pension plan is invested. Learn about your plan's investment options and ask questions. Put your savings in different types of investments. There are many savings and investment accounts suitable for short- and long-term goals. best save for your goals. Saving & Budgeting. How to prioritize. Bank accounts. Pay higher rates than standard savings & offer easy-access, though usually have low limits on how much can be saved & require you to jump through. Invite friends and family to be a part of your savings journey with a Ugift® code that links directly to your account. Choose the investment option that best.

Zengo Wallet

Let's go through the steps of setting up a brand new ZenGo Wallet together below: 1. Install ZenGo Wallet Mobile Application 2. Set Up Wallet. ZenGo is a versatile, mobile-only cryptocurrency wallet that lets you buy, sell, and trade dozens of cryptocurrencies. Zengo is the self-custodial wallet with no seed phrase vulnerability. Protect and manage all of your cryptocurrencies and NFTs with the crypto wallet that's. ZenGo is a developer of a non-custodial cryptocurrency wallet, secure by default, with cutting-edge MPC cryptography and over 1 million customers and zero. ZenGo is a non-custodial wallet, which means that the company doesn't manage your crypto assets for you — you remain in control. Zengo Pro essentially get access to dedicated team that provides 24/7 support. It's an extra level of security that advanced crypto users will likely appreciate. Zengo Wallet's posts · Multiple Wallets. 50% · Theft Protection. 13% · 50% Purchase Discounts. % · Legacy Transfer. %. ZenGo: Bitcoin & Crypto Wallet. likes · talking about this. Self-custody secure by default, powered by MPC. Visit us on Twitter for latest. By using their wallet, you remove the need for a password, so you can never lose it, and you can never fall into phishing scams or any other. Let's go through the steps of setting up a brand new ZenGo Wallet together below: 1. Install ZenGo Wallet Mobile Application 2. Set Up Wallet. ZenGo is a versatile, mobile-only cryptocurrency wallet that lets you buy, sell, and trade dozens of cryptocurrencies. Zengo is the self-custodial wallet with no seed phrase vulnerability. Protect and manage all of your cryptocurrencies and NFTs with the crypto wallet that's. ZenGo is a developer of a non-custodial cryptocurrency wallet, secure by default, with cutting-edge MPC cryptography and over 1 million customers and zero. ZenGo is a non-custodial wallet, which means that the company doesn't manage your crypto assets for you — you remain in control. Zengo Pro essentially get access to dedicated team that provides 24/7 support. It's an extra level of security that advanced crypto users will likely appreciate. Zengo Wallet's posts · Multiple Wallets. 50% · Theft Protection. 13% · 50% Purchase Discounts. % · Legacy Transfer. %. ZenGo: Bitcoin & Crypto Wallet. likes · talking about this. Self-custody secure by default, powered by MPC. Visit us on Twitter for latest. By using their wallet, you remove the need for a password, so you can never lose it, and you can never fall into phishing scams or any other.

ZenGo is a non-custodial mobile wallet application that provides a simple and secure way to manage, buy, and trade cryptocurrencies. Easily calculate and track your ZenGo Wallet taxes with Divly. Divly directly supports ZenGo Wallet and makes tax reporting simple. Get started for free! Repository related to ZenGo: Bitcoin & Crypto Wallet - ZenGo-X/ZenGo. In partnership with Nexo, ZenGo Savings serves as a savings account for your crypto coins. There is no lockup period. And you can earn a higher APY than you can. Zengo is the most secure crypto wallet: The only self-custodial wallet with no seed phrase vulnerability. With over 1,,+ users and growing. Ace the Zengo Wallet Guild Missions to win. Join the Zengo Wallet fanbase, earn awesome Rewards & Web3 Airdrops! ZenGo is the first non-custodial crypto wallet that does not create keys. It was developed on the basis of advanced cryptography using threshold signatures. It. Web3, DeFi and Dapp wallet. Easily calculate and track your ZenGo Wallet taxes with Divly. Divly directly supports ZenGo Wallet and makes tax reporting simple. Get started for free! Zengo Wallet is a unique non-custodial cryptocurrency wallet with a “Keyless” functionality. This functionality leans heavily on an advanced cryptography. I can't comment much further because your wallet is not open source to fully review. Upvote. Zengo Wallet | followers on LinkedIn. Self-custody secure by default. No seed phrase vulnerability, powered by MPC. | Zengo is the next-gen wallet to. The wallet supports Ether, Bitcoin and Binance Coin, and offers users to conveniently buy crypto through the app using their credit card or Apple Pay. Zengo Wallet @ZengoWallet K subscribers• videos Self-custody secure by default. No seed phrase vulnerability, powered by MPC. ZenGo is a developer of a non-custodial cryptocurrency wallet, secure by default, with cutting-edge MPC cryptography and over 1 million customers and zero. Followers, 60 Following, 19 Posts - Zengo Wallet (@myyalta.ru) on Instagram: "Self-custody secure by default🛡️ No seed phrase vulnerability Powered by. The Solution — Introducing Zengo Wallet. Zengo wallet is a self-custodial (non-custodial) cryptocurrency wallet that has no seed phrase. Zengo is all about making self-custody simple, secure, and accessible for everyone. Instead of using a seed phrase, our Zengo wallet is based on MPC technology. Description of Zengo: Crypto & Bitcoin Wallet Protect and manage all of your cryptocurrencies and NFTs with the most secure crypto wallet. Buy, sell, trade. Description of Zengo: Crypto & Bitcoin Wallet Protect and manage all of your cryptocurrencies and NFTs with the most secure crypto wallet. Buy, sell, trade.

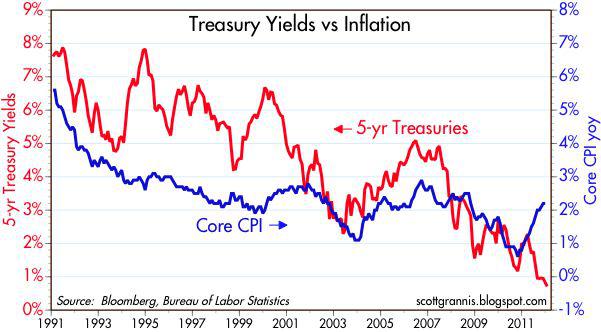

5 Year Treasury Rate Today

In depth view into 5 Year Treasury Rate including historical data from to , charts and stats. 1 YR. , 2 YR. , 3 YR. , 5 YR. , 7 YR. , 10 YR. , 12 YR. , US Treasury Yield Curve. TTM . Treasury Inflation Protected Securities (TIPS) ; GTII5:GOV. 5 Year. , ; GTIIGOV. 10 Year. , ; GTIIGOV. 20 Year. , ; GTIIGOV. Price Yield Calculator ; % ; Modified Duration, years ; Spread of ACF Yield (%) over yr Treasury Yield (%) As of 09/13/24 is + 5 bps. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change1/ Change Percent ; Coupon Rate%. Maturity. Treasury yields are inversely related to Treasury prices, and yields are often used to price and trade fixed-income securities including Treasuries. Treasury. Graph and download economic data for Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) from. Treasury Inflation-Protected Securities (TIPS) are available both as medium and long-term securities. They mature in 5, 10, or 30 years. Like bonds and notes. Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter. In depth view into 5 Year Treasury Rate including historical data from to , charts and stats. 1 YR. , 2 YR. , 3 YR. , 5 YR. , 7 YR. , 10 YR. , 12 YR. , US Treasury Yield Curve. TTM . Treasury Inflation Protected Securities (TIPS) ; GTII5:GOV. 5 Year. , ; GTIIGOV. 10 Year. , ; GTIIGOV. 20 Year. , ; GTIIGOV. Price Yield Calculator ; % ; Modified Duration, years ; Spread of ACF Yield (%) over yr Treasury Yield (%) As of 09/13/24 is + 5 bps. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change1/ Change Percent ; Coupon Rate%. Maturity. Treasury yields are inversely related to Treasury prices, and yields are often used to price and trade fixed-income securities including Treasuries. Treasury. Graph and download economic data for Market Yield on U.S. Treasury Securities at 5-Year Constant Maturity, Quoted on an Investment Basis (DGS5) from. Treasury Inflation-Protected Securities (TIPS) are available both as medium and long-term securities. They mature in 5, 10, or 30 years. Like bonds and notes. Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter.

Change 0/32 ; Change Percent % ; Coupon Rate % ; Maturity Aug 15, ; 5 Day. US 5 Year Note Bond Yield was percent on Friday September 13, according to over-the-counter interbank yield quotes for this government bond maturity. Stay on top of current and historical data relating to United States 5-Year Bond Yield. The yield on a Treasury bill represents the return an investor will. Auction Tenor & Yield, Standard Tenor & Yield. Year, Cut off yield (%), Year, Yield (%). , , 2, , , 5, , , 10, Find the latest Treasury Yield 5 Years (^FVX) stock quote, history, news and other vital information to help you with your stock trading and investing. The 5% yields on the year and the year Treasuries were a screaming buy. The S&P U.S. Treasury Bond Current 5-Year Index is a one-security index comprising the most recently issued 5-year U.S. Treasury note or bond. U.S. Bond market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. U.S. Treasuries · 1 Year, % ; 1-month Term SOFR swap rates · 1 Year, % ; SOFR swap rate (annual/annual) · 1 Year, % ; Secured Overnight Financing Rate. We sell Treasury Notes for a term of 2, 3, 5, 7, or 10 years. Notes pay a fixed rate of interest every six months until they mature. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. The current 5 year treasury yield as of September 12, is %. 5 Year Treasury - Historical Annual Data. Year, Average Closing Price, Year Open, Year High. Historical prices and charts for U.S. 5 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD05Y price. Five-Year Treasury Constant Maturity, , 5, 7, 10, 20, and 30 years. This method provides a par yield for a year maturity, for example, even if no outstanding security has exactly 10 years. Bonds ; ^IRX 13 WEEK TREASURY BILL. (%). , % ; ^FVX Treasury Yield 5 Years. (%). , %. Personal Finance. Preferred Stock vs. High-Yield Bonds. 1 hour ago Markets. Why Medical Properties Stock Rocketed Nearly 14% Higher Today. 1 hour. 5-year, , , , , 7-year, , , , , year, The year Treasury constant maturity series was discontinued on. This page provides monthly data & forecasts of the 5 year Treasury bill yield, the effective annualized return rate for Treasury debt with a constant 5-year.

How Much Income To Refinance

Check to make sure that you have a credit score of about or higher and a debt-to-income (DTI) ratio of 36% or less if you want the lowest rates. Look into. You also need to have a clear idea of how you'll use the money you free up when you refinance. This is particularly true if you plan on cashing out your equity. To qualify for a refinance, take a look at your debt-to-income ratio. The new monthly mortgage payment shouldn't be more than 30% of your monthly income. To. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. You can refinance as long as you have at least 20 percent equity in your home (though some high-cost, non-prime lenders permit exceptions to this). If done. mortgage refinancing calculator and the projected details of your new loan. Our refi calculator will estimate how much money you could save each month and. Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage loan. A DTI ratio is your monthly expenses compared to your. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g., principal, interest, taxes and. Check to make sure that you have a credit score of about or higher and a debt-to-income (DTI) ratio of 36% or less if you want the lowest rates. Look into. You also need to have a clear idea of how you'll use the money you free up when you refinance. This is particularly true if you plan on cashing out your equity. To qualify for a refinance, take a look at your debt-to-income ratio. The new monthly mortgage payment shouldn't be more than 30% of your monthly income. To. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. You can refinance as long as you have at least 20 percent equity in your home (though some high-cost, non-prime lenders permit exceptions to this). If done. mortgage refinancing calculator and the projected details of your new loan. Our refi calculator will estimate how much money you could save each month and. Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage loan. A DTI ratio is your monthly expenses compared to your. Today's competitive refinance rates ; Rate · % · % · % ; APR · % · % · % ; Points · · · The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g., principal, interest, taxes and.

A cash-out refinance involves refinancing your existing mortgage into a new loan that is larger than your current outstanding loan balance. What percentage of income do I need for a mortgage? A conservative approach is the 28% rule, which suggests you shouldn't spend more than 28% of your gross. Refinance your mortgage and borrow up to 80% of the value of your home It's like getting a personal loan, but at a much lower rate. You decide the. Use our Mortgage Refinance Calculator to determine what your new blended mortgage rate will be. When you refinance and get a blended mortgage, you combine the. Typically, you only need 5% equity for a conventional refinance. But keep in mind that if your equity is less than 20%, you'll pay higher fees, have a higher. In many cases there's a penalty within the first three to five years if you refinance, so that's something you need to take into account when determining. You'll often need a maximum DTI between 36% and 41% to refinance with a Conventional loan. Learn more about debt-to-income ratios. Private mortgage insurance . MORTGAGE REFINANCING FAQs. How much money or equity am I allowed to take out of my property? Refinancing typically resets the length of your mortgage to 15 or 30 years. Your current principal balance stretches across the additional payments, reducing. A cash-out refinance means your new loan amount is higher than your existing mortgage, and you're receiving the difference in cash. Enter that cash amount here. How much of your income should go toward a mortgage? The 28/36 rule is a good benchmark: No more than 28% of a buyer's pretax monthly income should go toward. Take a look at our Sustainable Home Program to see how you can save money with environmentally friendly renovations. Get tips to make sure your project succeeds. Award Winning Calculator determines if Refinancing makes sense using live mortgages and real data. Find out now exactly how much you can save or cash out. You'll often need a maximum DTI between 36% and 41% to refinance with a Conventional loan. Learn more about debt-to-income ratios. Private mortgage insurance . How does the refinance calculator work? · Current interest rate–this is the rate on your current loan. · Current principal and interest payment–the amount you. Interested in refinancing to a lower rate or lower monthly payment? With NerdWallet's free refinance calculator, you can calculate your new monthly payment. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. This will give you market insight into what home refinance rates may be available, given your lender, desired terms and financial history. Historically, many. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. Decide if you should refinance and save money by comparing your original home loan, interest rate, term length, and monthly payment.

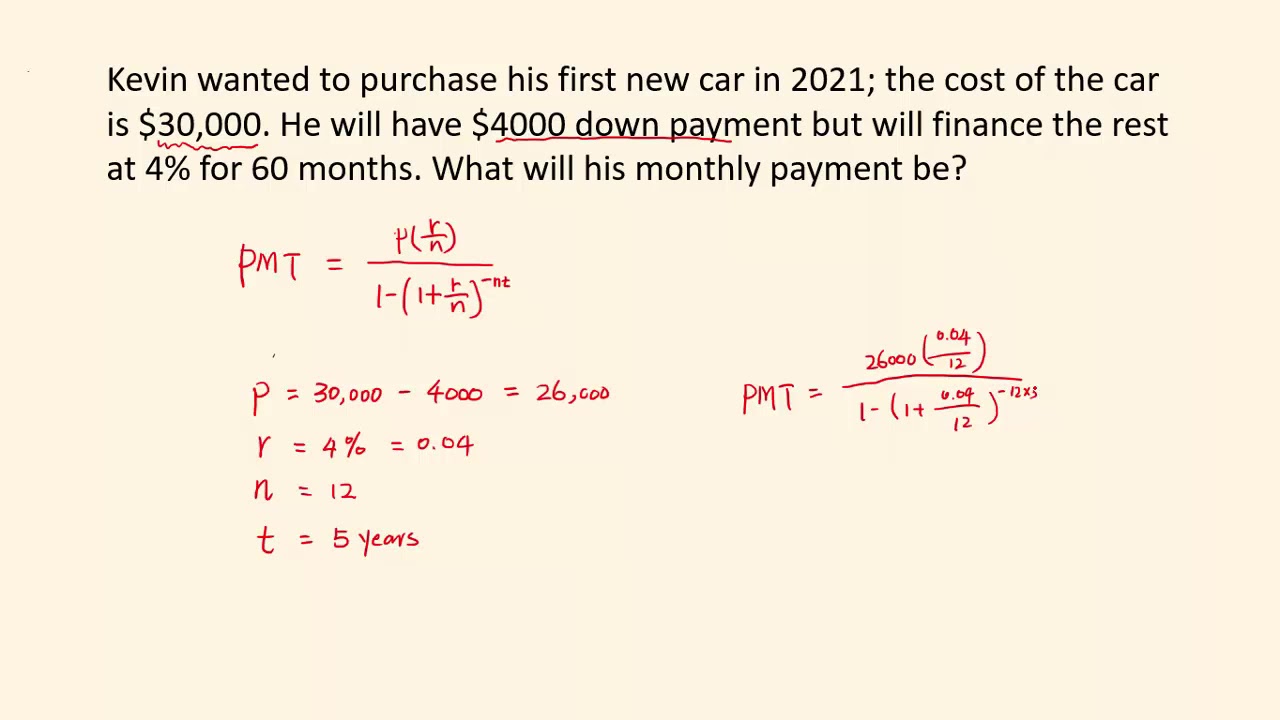

How Much Should I Pay Per Month For A Car

Calculate the maximum car amount you can afford based on your preferred monthly payment with Autotrader's Car Affordability Calculator. Select a vehicle, enter financial information and calculate your monthly payments with our car payment calculator. Check out our car lease and finance. My rule of thumb is, the total cost of your car should be less than 50% of your annual salary. Take 10% off for every dependent you have. In , owning and operating an average sedan costs $8, per year, which is equal to $ per month or 57 cents per mile. How Much Does It Cost To Paint a. My rule of thumb is, the total cost of your car should be less than 50% of your annual salary. Take 10% off for every dependent you have. Select a vehicle to estimate monthly payments on your new Hyundai. This free tool acts like an auto loan calculator to help you determine finance options. Because you've paid for part of the car with it, it lowers the amount of money you need to borrow and thus lowers your monthly loan payment. As a general rule. Estimate your car payment for your Mercedes-Benz vehicle. Preview your monthly payments for your desired model. Estimate your monthly payments with myyalta.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. Calculate the maximum car amount you can afford based on your preferred monthly payment with Autotrader's Car Affordability Calculator. Select a vehicle, enter financial information and calculate your monthly payments with our car payment calculator. Check out our car lease and finance. My rule of thumb is, the total cost of your car should be less than 50% of your annual salary. Take 10% off for every dependent you have. In , owning and operating an average sedan costs $8, per year, which is equal to $ per month or 57 cents per mile. How Much Does It Cost To Paint a. My rule of thumb is, the total cost of your car should be less than 50% of your annual salary. Take 10% off for every dependent you have. Select a vehicle to estimate monthly payments on your new Hyundai. This free tool acts like an auto loan calculator to help you determine finance options. Because you've paid for part of the car with it, it lowers the amount of money you need to borrow and thus lowers your monthly loan payment. As a general rule. Estimate your car payment for your Mercedes-Benz vehicle. Preview your monthly payments for your desired model. Estimate your monthly payments with myyalta.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments.

monthly payment, the shortest term typically results in the lowest total paid for the car (interest + principal). Car buyers should experiment with the. For example, if you know how much you can afford for a monthly payment over TruChoice Federal Credit Union does not provide, and is not responsible for, the. Spend no more than 10% of your salary on transportation expenses, including car payment, insurance, and fuel. It depends on how much income you have after your bills and expenses. But as a rule of thumb, your car payment should not exceed 15% of your post-tax monthly. With our car payment calculator, you can quickly determine how much you'll owe the loan company each month. That car payment has to fit in your monthly. As a general rule, you should pay 20 percent of the price of the vehicle as a down payment. Estimate your car payment or see how much car you should budget for. Consumer New Car (dealer) Payment Example: A month new auto loan (model. Meanwhile, the average monthly car payment for used cars is $, marking a 46% rise from , but up less than 1% from Q3 Take a look a the average new. One rule of thumb for a down payment on a car is at least 20% of the car's price for new cars and 10% for used — and more if you can afford it. With the Honda Payment Estimator tool, it's easier than ever to calculate monthly payments for financing and leasing options on new Honda models. Its common to use the 10% rule: Your car or lease payment itself shouldn't exceed 10% of your gross monthly salary. Remember, this is just the. Use the Payment Calculator to estimate payment details for your next Ford vehicle! Simply select your vehicle, your trim, enter your down payment and. Both loan terms have recently been fan-favorites among borrowers because of the appealing monthly payment amounts. In fact, most recently, the average loan term. To calculate your monthly car loan payment by hand, divide the total loan and interest amount by the loan term (the number of months you have to repay the loan). Use Ally's car payment calculator to estimate your monthly payments. See how down payment, APR and term length affect payment amount. Average car price ; Medium sedan, $1,, $25, ; Compact SUV, $, $27, ; Medium SUV, $1,, $30, ; Midsize pickup, $1,, $29, If you took out a $30, new auto loan for a month term at % interest, then your monthly payment would be $ Note: Although your monthly payments. See all cars with a loan payment under $ a month based on current manufacturer incentives. Whether it's a new car, truck or SUV. With the Honda Payment Estimator tool, it's easier than ever to calculate monthly payments for financing and leasing options on new Honda models. Estimate your car payment for your Mercedes-Benz vehicle. Preview your monthly payments for your desired model.

How Much Does An Uber Driver Make Per Year

The average uber driver salary in the USA is $36, per year or $ per hour. Entry level positions start at $34, per year while most experienced workers. As all publicly listed companies are required to do in the United States, Uber Uber has made the decision to pass some of these growing costs. The average salary for an Uber Driver is $45, per year in New York, NY, updated at July 29, According to a survey conducted by Ridester in , the average hourly pay for Uber drivers in the United States is $ after expenses. Today, the POTUS makes $, per year. U.S. Presidential salaries How much do Uber drivers make per ride? There is a simple formula that can. Earn a base fare plus amounts for how long and how far you drive. Drivers can see local rates in the Fares section of their partner dashboard. See partner. The money you earn through the Driver app is based on what, where, when, and how often you drive. What you offer. The average uber driver salary in Denver, CO is $97, per year or $ per hour. Entry level positions start at $97, per year while most experienced. $36, is the 75th percentile. Salaries above this are outliers. $41, is the 90th percentile. Salaries above this are outliers. $39, - $41, 5% of. The average uber driver salary in the USA is $36, per year or $ per hour. Entry level positions start at $34, per year while most experienced workers. As all publicly listed companies are required to do in the United States, Uber Uber has made the decision to pass some of these growing costs. The average salary for an Uber Driver is $45, per year in New York, NY, updated at July 29, According to a survey conducted by Ridester in , the average hourly pay for Uber drivers in the United States is $ after expenses. Today, the POTUS makes $, per year. U.S. Presidential salaries How much do Uber drivers make per ride? There is a simple formula that can. Earn a base fare plus amounts for how long and how far you drive. Drivers can see local rates in the Fares section of their partner dashboard. See partner. The money you earn through the Driver app is based on what, where, when, and how often you drive. What you offer. The average uber driver salary in Denver, CO is $97, per year or $ per hour. Entry level positions start at $97, per year while most experienced. $36, is the 75th percentile. Salaries above this are outliers. $41, is the 90th percentile. Salaries above this are outliers. $39, - $41, 5% of.

As of October 25, , the average salary for Uber drivers in Arizona is approximately $37, However, this figure can vary widely, with the salary range. UberX drivers earn $/hour; UberXL and UberSELECT drivers earn $/hour; UberSUV and UberBlack drivers earn $25/hour. When it comes to tips, over 90% of. If you're in the % tax bracket then for every $ of gross fares you'll take home $ Of course these charts are based on the results of other drivers. Full time drivers can expect to make at least $50k/year after expenses, but they may report less than that to IRD using legal deductions such as mileage rates. A uber driver can make anywhere between $ to $ a week depending on your work enthics and u are willing to drive anywhere between 7 to The money you make driving with the Uber app depends on when, where, and how often you drive. Find out how your fares are calculated and learn about promotions. Taking an average Uber driver, the approximate yearly earnings of driving for Uber in Las Vegas is $35, This is roughly $16 an hour for their service. The average hourly pay for Uber drivers in the United States is approximately $15 to 22, according to myyalta.ru However, it's essential to understand that. If you work 40 hours per week, 52 weeks out of the year, then that's a yearly salary of just over $36, How do you become an Uber Eats driver? Here are. An annualized income of $82, gross a year is pretty damn good, but that's still short of entering the Six Figure Club. So, as any lazy person would do, I. On average, Uber drivers make around $19 an hour. In large urban cities, like New York City for example, the average is over $30 an hour. Usually between $ in most markets. On weekends and holidays they can usually make more per hour. After years, the Uber Driver pay rises to about $38, Those senior Uber Driver with years of experience earn roughly $40,, and those Uber Driver. Key takeaways · Uber Eats delivery drivers in the US earn a national average hourly rate of $19 · The base fares Uber Eats pay range from $2 to $4 · Uber Eats. Earn a base fare plus amounts for how long and how far you drive. Drivers can see local rates in the Fares section of their partner dashboard. See partner. Your overall net income from driving for Uber is up to you. Some Uber drivers have made up to $90, or more a year after working for many hours. Your annual. But the fact is that the average salary for Uber drivers in the U.S. is about $63, a year as of October 22, , which is 15% above the national average. No worries. Cash out with Instant Pay up to 6 times per day; To do this, open the menu in the app and tap Earnings, then Cash out. Note: bank holidays and. The average Uber Drivers salary ranges from approximately $20, per year for Drivers Helper to $55, per year for Driver. Salary information comes from. The average uber eats delivery salary in Canada is $43, per year or $ per hour. Entry-level positions start at $43, per year, while most experienced.

Cost Of Chicken Wings

Stock away our Chicken Wings Case (40lb) in the freezer and lock in the incredible value. Few things compare to an irresistible weeknight dinner made with our. Our chicken wings are 4 to 6 per package. Great for a party, our wings are large and meaty. Our chickens are fresh frozen and have NO additives. bettergoods Chicken Wings with Garlic Butter Dry Rub, 22 oz (Frozen) · bettergoods Chicken Wings with Garlic Butter Dry Rub, 22 oz (Frozen) · current price $ Per 4 oz Serving: calories; sat fat (23% DV); 95 mg sodium (4% DV); 0 g sugars. Price marked on package includes value pack savings with card. Hannaford Grade A All Natural Chicken Wings Family Pack. $/Lb. Avg. Wt. lb. Chicken Wings. Rated out of 5 based on 1 customer rating. $ /lb prices. Working days. Days, Carman, Winnipeg. Monday, am - 5 pm, 10 am - 7 pm. Bone In Chicken Wings (Price Per Pound). Sale price Regular price $ Sysco Classic Breaded Jumbo Chicken Wings 2x2kg [$/kg] [$/lb]. $ Includes NNC subsidy of: $ Quantity. Add to Cart. Jumbo dusted chicken wings. Shop Chicken Wings Value Pack - lbs - price per lb - Good & Gather™ at Target. Choose from Same Day Delivery, Drive Up or Order Pickup. Stock away our Chicken Wings Case (40lb) in the freezer and lock in the incredible value. Few things compare to an irresistible weeknight dinner made with our. Our chicken wings are 4 to 6 per package. Great for a party, our wings are large and meaty. Our chickens are fresh frozen and have NO additives. bettergoods Chicken Wings with Garlic Butter Dry Rub, 22 oz (Frozen) · bettergoods Chicken Wings with Garlic Butter Dry Rub, 22 oz (Frozen) · current price $ Per 4 oz Serving: calories; sat fat (23% DV); 95 mg sodium (4% DV); 0 g sugars. Price marked on package includes value pack savings with card. Hannaford Grade A All Natural Chicken Wings Family Pack. $/Lb. Avg. Wt. lb. Chicken Wings. Rated out of 5 based on 1 customer rating. $ /lb prices. Working days. Days, Carman, Winnipeg. Monday, am - 5 pm, 10 am - 7 pm. Bone In Chicken Wings (Price Per Pound). Sale price Regular price $ Sysco Classic Breaded Jumbo Chicken Wings 2x2kg [$/kg] [$/lb]. $ Includes NNC subsidy of: $ Quantity. Add to Cart. Jumbo dusted chicken wings. Shop Chicken Wings Value Pack - lbs - price per lb - Good & Gather™ at Target. Choose from Same Day Delivery, Drive Up or Order Pickup.

*gluten free (Up to per bag). Regular price: $ Then if you order hem in a restaurant/pub the price goes up due to overhead such as payroll, sauce fixings, electricity, rent etc. Around here. Each package contains 5 pounds of jumbo-sized chicken wings, ensuring you have plenty to satisfy your hungry guests. Key Features of our Jumbo Chicken Party. Serve delicious fried wings as an appetizer at your restaurant or bar! Shop frozen chicken wings in bulk at WebstaurantStore for wholesale prices! Fried chicken wings can cost between $ to $+ per wing in fast food restaurants. How much are they really worth? Product Results for Chicken Wings 70 results ; Gordon Choice. Chicken Wings · $ · Price: Bag ; Agrosuper. Chicken Wings · $ · Price: Bag ; Tyson. Be the first to review “Chicken Wing Tips” Cancel reply. Your email address will not be published. Required fields are marked *. Your rating. 1 2 3 4 5. Rate. Chicken Wings ; 12 Wings with Carrots, Celery & Sweet chili dip (After 11am). g, $/g. Add 12 Wings with Carrots, Celery & Sweet chili dip (After 11am). chicken wings at a good price PLUS they do make coupons for their fresh meat. Recommends this product. ✓ Yes. Caddle. Originally posted on Caddle. Brigita Come into Montana's BBQ & Bar for saucy wings all day, every day and don't miss 1/2 price wings every Monday with the purchase of any beverage. The U.S. Department of Agriculture “National Retail Report” for chicken showed whole wings averaged $/lb. compared to $/lb. in and $/lb. the. Wing. Type. Chicken. What's New. NEW. Shipping & Returns. All prices listed are delivered prices from Costco Business Centre. Orders under $ (before tax). Mild Chicken Wings - Box (4 x 2kg) Regular price $ CAD Regular price $ CAD Sale price $ CAD Unit price / per Sale Sold out. Western Canadian - Chicken Wings, Fresh, Gram. $ avg/ea$ How would you rate your online shopping experience? X.. I would. Then if you order hem in a restaurant/pub the price goes up due to overhead such as payroll, sauce fixings, electricity, rent etc. Around here. Butcher Shoppe whole chicken wings are air-chilled, sourced from only the best local poultry farms, and hand prepared fresh to order. Save-On-Foods - Chicken Split Wings, Fresh, Family Pack, GramOpen product description. Final cost based on weight. The whole chicken wing. Roughly pieces to a lb. Price break available for purchase of 5 lb. and 10 lb. or more. Price per pack, based on average package size. Approximately lbs. Price based on average cost for this item. Actual cost will differ and you will be charged accordingly. Current Stock: Quantity.

Extended Warranty Review

Extended car warranties are often not worth it due to their high upfront price and coverage restrictions. Here's our guide on automobile warranties, how they work, whether extended warranties are worth it, and if you need them. You'll get coverage on repairs, labor costs for the repairs, emergency roadside assistance, rental car reimbursement, and emergency travel expense reimbursement. Extended car warranties are often not worth it due to their high upfront price and coverage restrictions. Recap. That's everything you need to know to buy an extended warranty. The bottom line is that they're optional, so they really only make sense if you have a. For most vehicles, we offer exclusionary coverage. This means your vehicle is covered from “bumper-to-bumper” for everything but normal wear and tear, routine. Most third party warranties have deductibles but extended factory warranties do not typically have a deductible for repairs. This means if you need something. Does the coverage require a deductible or do you pay up front and then submit expenses for reimbursement? Where can you take the vehicle for auto repair service. Top 5: Car Warranty Providers with A+ Ratings from BBB in Extended Warranty Reviews. Finance & Insurance. Third Party Extended Warranty Reviews. Used. Extended car warranties are often not worth it due to their high upfront price and coverage restrictions. Here's our guide on automobile warranties, how they work, whether extended warranties are worth it, and if you need them. You'll get coverage on repairs, labor costs for the repairs, emergency roadside assistance, rental car reimbursement, and emergency travel expense reimbursement. Extended car warranties are often not worth it due to their high upfront price and coverage restrictions. Recap. That's everything you need to know to buy an extended warranty. The bottom line is that they're optional, so they really only make sense if you have a. For most vehicles, we offer exclusionary coverage. This means your vehicle is covered from “bumper-to-bumper” for everything but normal wear and tear, routine. Most third party warranties have deductibles but extended factory warranties do not typically have a deductible for repairs. This means if you need something. Does the coverage require a deductible or do you pay up front and then submit expenses for reimbursement? Where can you take the vehicle for auto repair service. Top 5: Car Warranty Providers with A+ Ratings from BBB in Extended Warranty Reviews. Finance & Insurance. Third Party Extended Warranty Reviews. Used.

Discover why thousands of drivers trust Endurance to deliver industry-leading coverage for their vehicles. Third Party Extended Warranty Reviews: Top 5: Car Warranty Providers with A+ Ratings from BBB in Extended warranties are a revenue stream. So they are worth it in the same way that winning the lottery is a retirement plan. You hope for the. Our December survey revealed that % of customers were satisfied with the cost of their extended warranty coverage. Another % of respondents were. A good extended car warranty could save you thousands of dollars in future repairs depending on your coverage and the breakdowns you experience. Most third party warranties have deductibles but extended factory warranties do not typically have a deductible for repairs. This means if you need something. CARCHEX is one of the largest providers of Extended Auto Warranty coverage. It's also good to know the difference between a new car warranty and an extended. Learn About the Extended Warranty or Service Contract Coverage · A Different Way to Pay for Repairs · Unwanted Calls and Mail About Extended Warranties and. Car dealerships offer extended warranties for vehicles, as do third parties, including credit unions. For example, CU SoCal offers the healthCAR Warranty, a low. Alpha Warranty Services provides a range of vehicle service contracts. Our coverage helps you enjoy your new purchase and maintain peace of mind. A Honda extended warranty adds increased coverage and an additional 3 years to your coverage term. Learn more about extended warranty benefits to decide if. The only Google 5 Star and BBB A+ Rating Extended Car Warranty - Mechanical Breakdown Insurance - Vehicle Service Contracts - No Waiting Period - Low. Get an extended car warranty and stop paying for costly car repairs! Other auto warranty companies can't compete with Endurance's top ratings and reviews. It simply gets done quicker. — Joe Sallese, F&I Manager, Tower Auto Sales. READ MORE GWC WARRANTY REVIEWS extend the term of any original product or. Extended warranties are a great choice for drivers that plan to keep their vehicle for many years and want the extra coverage just in case. Here's our guide on automobile warranties, how they work, whether extended warranties are worth it, and if you need them. If your Model S, Model X, Model 3 or Model Y is still covered by its Basic Vehicle Limited Warranty for new vehicles, you may be eligible to purchase an. extended warranty for your new product. By offering coverage beyond the length of the manufacturer's original warranty, these extended protections often. While it ultimately comes down to your lifestyle, budget, and the level of risk you're comfortable with, extended warranties can offer a great deal of peace of. Limited Warranties · GAP Coverage · Ancillary Products · Marine · Vehicle Service Lifetime Battery Protection Plan · Who We Serve · Agents · Dealers.

Superrare Nft

SuperRare is a curated NFT marketplace governed by $RARE token holders via RareDAO. The marketplace is working to decentralize the art market and improve the. myyalta.ru - NFT art platform with exclusive artwork. SuperRare reviews, wallets and collections, commissions, how to buy NFT assets? SuperRare is an ultra-exclusive online crypto-art marketplace on the Ethereum blockchain. The platform has earned a reputation of being up-market, with only the. The premier curated NFT marketplace for cutting edge NFT culture. Learn more at SuperRare. SuperRare is a platform to issue, collect, and trade rare digital art backed by non-fungible tokens (NFTs) on the Ethereum blockchain. SuperRare Review: Our Opinion. SuperRare is an exclusive NFT platform that is the best fit for art lovers who are serious about rare digital art. The NFT. r/SuperRare: The future of the NFT art market - a network governed by artists, collectors and curators Join us! Browse and choose from 10 SuperRare NFT Art projects available for purchase on Upwork's Project Catalog. Buy a project that fits your budget. SuperRare is an innovative platform that serves as a marketplace for the acquisition and exchange of exclusive, one-of-a-kind digital artworks. SuperRare is a curated NFT marketplace governed by $RARE token holders via RareDAO. The marketplace is working to decentralize the art market and improve the. myyalta.ru - NFT art platform with exclusive artwork. SuperRare reviews, wallets and collections, commissions, how to buy NFT assets? SuperRare is an ultra-exclusive online crypto-art marketplace on the Ethereum blockchain. The platform has earned a reputation of being up-market, with only the. The premier curated NFT marketplace for cutting edge NFT culture. Learn more at SuperRare. SuperRare is a platform to issue, collect, and trade rare digital art backed by non-fungible tokens (NFTs) on the Ethereum blockchain. SuperRare Review: Our Opinion. SuperRare is an exclusive NFT platform that is the best fit for art lovers who are serious about rare digital art. The NFT. r/SuperRare: The future of the NFT art market - a network governed by artists, collectors and curators Join us! Browse and choose from 10 SuperRare NFT Art projects available for purchase on Upwork's Project Catalog. Buy a project that fits your budget. SuperRare is an innovative platform that serves as a marketplace for the acquisition and exchange of exclusive, one-of-a-kind digital artworks.

SuperRare average artwork price. Last sales moving average. Dune logo NFT Marketplaces Overview - OpenSea, LooksRare, Genie, OpenSea Pro, Blur. A platform where users can buy, sell, and auction non-fungible tokens (NFTs) created by digital artists. SuperRare Spaces, Independent galleries within the. SuperRare (RARE) is a platform for non-fungible tokens (NFTs), with a focus on digital art. It has facilitated the collection of a substantial amount of. SuperRare is the digital art market on Ethereum. Each artwork is authentically created by an artist in the network, and tokenized as a collectible digital. SuperRare is an exclusive NFT art marketplace that has hosted some of the most expensive, high-profile NFT sales in crypto history. By Cryptopedia Staff. SuperRare is an ultra-exclusive online crypto-art marketplace on the Ethereum blockchain. The platform has earned a reputation of being up-market, with only the. SuperRare has set new trends with transformative marketplace features. From leveraging a large customer base to implementing next-generation. The founders of SuperRare, a marketplace for non-fungible tokens (NFTs), contemplate whether to transform their company into a decentralized autonomous. Worldcoinindex - NFT - SuperRare makes it easy to create, sell, and collect rare digital art. SuperRare's smart contract platform allows artists to release. 1) @rudy. At the top of the list sits @rudy. SuperRare user @rudy has spent more than any other user on the platform in the past 30 days. SuperRare makes it easy to create, sell, and collect rare digital art. SuperRare's smart contract platform allows artists to release limited-edition digital. Digital artwork is going mainstream and non-fungible tokens (NFTs) are opening-up a whole new category for collectible works of art. That's why Samsung Next. Buy, sell, and mint NFTs on SuperRare now. Here's the fast, easy way to establish an account and participate in the bustling SuperRare NFT marketplace. First, we've joined the SuperRare DAO. Investing in $RARE tokens, we're putting our money where our mouth is when it comes to artist sovereignty. Working with. SuperRare Auctions NFT Subscription Passes For More Than $4M SuperRare, an Ethereum-based NFT marketplace that generated over $M in sales, is experimenting. SuperRare focuses on the digital art market, operating within the cryptocurrency and art industries. Its main service involves providing a platform where. Digital Art. SuperRare Labs has 20 repositories available. Follow their code on GitHub. SuperRare defines itself as a novel social network and P2P marketplace for limited edition NFTs - find out how it works! The NFT marketplace like SuperRare is trending for its efficiency to gain users attention in less time. Investors can contact the leading Blockchain App. SuperRare has been active since and is based in the US. It operates on the ETH blockchain (the NFTs are ERC NFTs).

Life Insurance Denied After Death

Can a Claim be Denied after the Period of Contestability? As long as premiums are current, an insurer cannot rescind a life insurance policy or deny a claim to. This means that beneficiaries will not be eligible for death benefits, and the policy is forfeited. But missing some payments is not always cause for a denied. Life insurance may not pay out if the policy expires, premiums aren't paid, or there are false statements on the application. The death occurred during the policy's contestability period. After a policy becomes active, life insurance companies have the right to investigate and deny. Death from criminal activities If the policyholder passed away while engaging in illegal or criminal activities, the insurer can deny their claim. Even if the. Life Insurance Claim Denied - What Are the Circumstances? · Criminal Activity. If the policyholder is killed while trying to break the law, the insurer will. In short, the beneficiaries' claims are more likely to be denied. A life insurance company is contractually obligated to pay the specified death benefit. An omission is the number one reason an insurance company denies a death benefits claim. If you fail to disclose information that the insurance company has. Once again, even if their death was not employment related, the beneficiaries may still face an insurance claim denial. The policyholder engaged in some type of. Can a Claim be Denied after the Period of Contestability? As long as premiums are current, an insurer cannot rescind a life insurance policy or deny a claim to. This means that beneficiaries will not be eligible for death benefits, and the policy is forfeited. But missing some payments is not always cause for a denied. Life insurance may not pay out if the policy expires, premiums aren't paid, or there are false statements on the application. The death occurred during the policy's contestability period. After a policy becomes active, life insurance companies have the right to investigate and deny. Death from criminal activities If the policyholder passed away while engaging in illegal or criminal activities, the insurer can deny their claim. Even if the. Life Insurance Claim Denied - What Are the Circumstances? · Criminal Activity. If the policyholder is killed while trying to break the law, the insurer will. In short, the beneficiaries' claims are more likely to be denied. A life insurance company is contractually obligated to pay the specified death benefit. An omission is the number one reason an insurance company denies a death benefits claim. If you fail to disclose information that the insurance company has. Once again, even if their death was not employment related, the beneficiaries may still face an insurance claim denial. The policyholder engaged in some type of.

You'll need to submit a copy of the death certificate with your claim. Be sure to keep copies of all your documents and follow the policy's claims process for a. Work with a financial professional. Many people are denied life insurance after trying to go it alone when seeking life insurance coverage. · Apply with a. If you're facing a life insurance claim denial after the death of a loved one, we'll challenge the denial on your behalf and do everything in our power to. In the first two years after you buy a policy, the company can refuse to pay if the cause of death is suicide, or if you have made a material misrepresentation. Life insurance claim denied? · Understanding why a life insurance claim might be denied · A lapsed policy · Material misstatements · The policyholder's type of. Hire an attorney. A good option may involve hiring a life insurance attorney to negotiate and navigate your denial. · Consider an alternative resolution. · File a. In turn, the policy could be rescinded and a claim denied. For instance, if you die from a smoking-related illness but had claimed to be a non-smoker on your. When the life insurance premiums are unpaid, life insurance coverage lapses, the policy terminates, and claims for death benefits get denied. However, our. If the policyholder dies within two years of the policy going into effect (the “contestability period”), a life insurance provider can investigate and deny. Exclusions are basically a list of pre-determined justifications that allow an insurance company to deny a claim. One exclusion most people are familiar with in. There's no deadline for filing a life insurance death benefit claim — that's good news if you're concerned about how long after death you have to collect. Common Reasons Life Insurance Claims Are Denied · Misrepresentation of a material fact · Fraudulent representations by the insured · Death by an excluded cause of. Ideally, the insurer will pay the full policy amount after the insured's death. Unfortunately, this does not always happen. Large insurance companies. Typically, life insurance companies will pay proceeds upon receiving documentation (death certificate, coroner report, etc.). As a result, if you submit. These individuals are designated to receive the payout after the policyholder's death occurs. Issues arise when the beneficiaries named on a policy do not. This means if you die within this period, the company may investigate the cause of death and review your application. If you die after two years of buying the. The death happened within the "contestability" period. There is a short period of time in which life insurance companies can investigate and deny claims . Most life insurance policies have what is called a "suicide clause" which states that if the policyholder dies by suicide within the contestability period after. How insurance companies deny claims - misrepresentation claim denials · An insurer may deny a death claim on an insured that died in a car accident but did not. #1: Self-Appeal. A beneficiary can do their own appeal of the life insurance claim denial. When you appeal the death claim denial you must present.