myyalta.ru

Community

How To Determine Square Feet Of A Room

The formula used to calculate square feet involves multiplying the length of an area by its width. For instance, if you have a room that is For instance, if the room is rectangular, measure the length and width in feet. Then, multiply them together to find the area in square feet. For oddly shaped. If it is a square/oblong room just measure the length and width (in ft) then multiply the two measurements and you have the square footage. Once you have the length and width measurements, you're ready to calculate the area of the room. Multiply the length by the width to obtain the square footage. It's easy to learn how to calculate the square footage of a room. You simply measure and multiply the length and width of the room. In the United States, this. Multiply the length by the width to create the square foot measurement for the room. If the length is 14 feet and the width is 10 feet, you have a calculation. Do the math the same way, then divide by to get your total in square feet. When calculating square footage account for the entire space (i.e. under vanity/. All you need to do is multiply the length of the room by the width of the room. From example, if a room is 10 feet wide and 15 feet long, you would multiply The formula involves multiplying the length and width of a room or area to determine its square footage. The formula used to calculate square feet involves multiplying the length of an area by its width. For instance, if you have a room that is For instance, if the room is rectangular, measure the length and width in feet. Then, multiply them together to find the area in square feet. For oddly shaped. If it is a square/oblong room just measure the length and width (in ft) then multiply the two measurements and you have the square footage. Once you have the length and width measurements, you're ready to calculate the area of the room. Multiply the length by the width to obtain the square footage. It's easy to learn how to calculate the square footage of a room. You simply measure and multiply the length and width of the room. In the United States, this. Multiply the length by the width to create the square foot measurement for the room. If the length is 14 feet and the width is 10 feet, you have a calculation. Do the math the same way, then divide by to get your total in square feet. When calculating square footage account for the entire space (i.e. under vanity/. All you need to do is multiply the length of the room by the width of the room. From example, if a room is 10 feet wide and 15 feet long, you would multiply The formula involves multiplying the length and width of a room or area to determine its square footage.

In a square or rectangle area, the square footage is determined by simply multiplying the length by the width in feet. A single unit in square footage is 1. To calculate the area of a wall, use the standard formula of Length x Width = Area. Next, use the same formula to record the individual area of windows and. If the shape of your room is irregular, then it would be best to divide the area into smaller shapes and add up the individual areas. How to Use This Calculator. If the shape of your room is irregular, then it would be best to divide the area into smaller shapes and add up the individual areas. How to Use This Calculator. To find the square feet of a room, multiply the length of the room by the width of the room. The length and width can be found by measuring the distance between. How to Calculate Square Footage of a House or Apartment To get the total square footage of a house or apartment, measure the square footage of each room or. Add up the areas of all the smaller shapes to get the total square footage for the room. Calculating Square Footage for Multi-Level Spaces. When calculating the. To calculate the square footage of a room, multiply the length by the width. For example, if a room is 10 feet long and 12 feet wide, the square footage of the. You just multiply the length of a room or house in feet by the width in feet. Unfortunately, that equation only applies to rooms and homes that are. Take the length and multiply it (with your calculator) by the width to get the square footage (or area) of the room. To calculate the square feet area of a square or rectangular room or area, measure the length and width of the area in feet. Then, multiply the two figures. One can use a tape measure and measure the interior dimensions of each room and that is another way. One might take the interior W x L for. To calculate the square feet area of a square or rectangular room or area, measure the length and width of the area in feet. Then, multiply the two figures. Calculating Cost Per Square Foot. When painting a house, installing flooring, or building a home, the square footage of the property is often used to determine. For Rolled Goods, like Carpet and Sheet Vinyl, measure from edge to edge of the room, including closets and other nooks in the space. Measuring to account for. To calculate square feet using feet, simply multiply the length of the area by its width in feet. For instance, if a room is 10 feet long and 15 feet wide, its. Step 1: Figure out the square footage of each room in which you want to install laminate-wood floors. To do so, use a tape measure to determine the room's. To find the square footage -- or the area -- of the space, just multiply the length times the width, just as you would do with any rectangle. Ex: 12 feet ( m). To find the square footage of the area, divide the irregular shape into multiple squares or rectangles, labeled A, B, C, and D. Find the Area of A, B, C and D. You just multiply the length of a room or house in feet by the width in feet. Unfortunately, that equation only applies to rooms and homes that are.

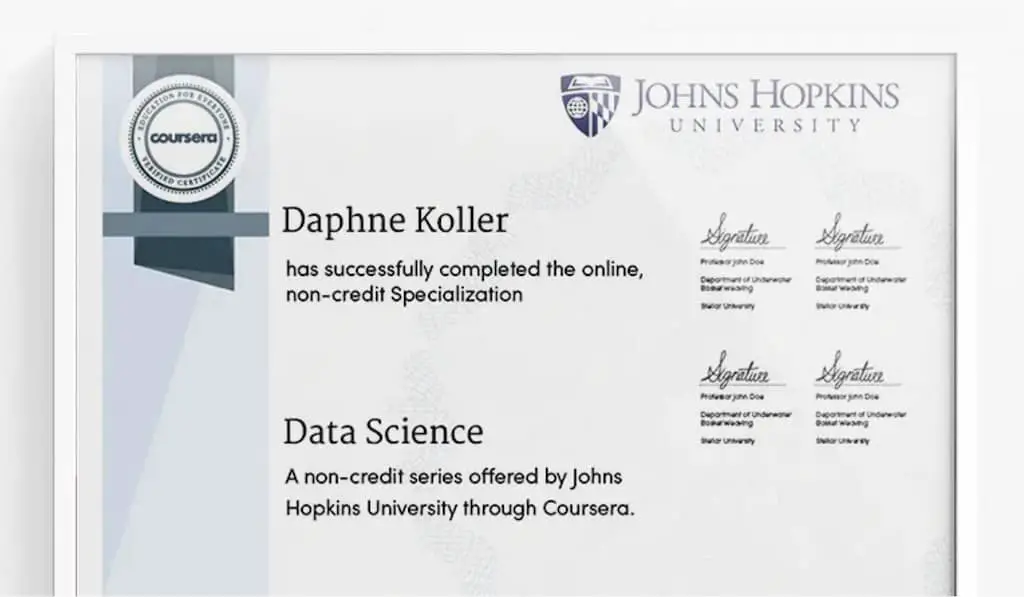

Coursera Degrees Worth It

Enroll in flexible, % online master's degree programs. Set your own schedule to balance your work and personal commitments and complete coursework at your. However, these certificates and specializations are unlikely to make a difference in your college admissions process. A UNIQUE STRATEGY FOR USING COURSERA & edX. When combined with a solid portfolio or online degree, a Coursera course can boost your myyalta.rusional certifications on Coursera usually come after. It's also worth noting that on April 25, , Coursera Finally, Coursera offers students the possibility to earn fully accredited degrees on its platform. Illinois Tech is excited to partner with Coursera to provide learners from throughout the world with future-focused, accredited, percent online degree. On Coursera, learning “stacks” together so you can build toward the educational outcome that's best for you. For instance, you can enroll in pre-approved. Can you really earn a full University degree online? The answer is YES! Not only that, Coursera is partnered with some of the leading Universities and. The benefits of taking a MOOC are obvious: flexible learning hours at a fraction of the cost of a traditional business degree. While MBA degrees can cost. Is a Bachelor's Degree Worth It? Discover whether getting an undergraduate degree makes sense for you. Last updated on November 29, Article. Enroll in flexible, % online master's degree programs. Set your own schedule to balance your work and personal commitments and complete coursework at your. However, these certificates and specializations are unlikely to make a difference in your college admissions process. A UNIQUE STRATEGY FOR USING COURSERA & edX. When combined with a solid portfolio or online degree, a Coursera course can boost your myyalta.rusional certifications on Coursera usually come after. It's also worth noting that on April 25, , Coursera Finally, Coursera offers students the possibility to earn fully accredited degrees on its platform. Illinois Tech is excited to partner with Coursera to provide learners from throughout the world with future-focused, accredited, percent online degree. On Coursera, learning “stacks” together so you can build toward the educational outcome that's best for you. For instance, you can enroll in pre-approved. Can you really earn a full University degree online? The answer is YES! Not only that, Coursera is partnered with some of the leading Universities and. The benefits of taking a MOOC are obvious: flexible learning hours at a fraction of the cost of a traditional business degree. While MBA degrees can cost. Is a Bachelor's Degree Worth It? Discover whether getting an undergraduate degree makes sense for you. Last updated on November 29, Article.

Coursera was formed in to transform lives through open access to world class education. Today, with 92 million learners and 7,+ courses from top. Coursera is not just for people wanting to gain a degree in a traditional subject. The platform has plenty of choices when it comes to courses and all of them. Coursera offers many courses at different rates. · MasterTrack™ Certificates on Coursera split Master's programs into modules so that learners can affordably. Does the ME-EM diploma say this is an "online" degree? $23k? That's a lot considering the way Coursera markets itself. But I do agree, it's a step in the right direction. It also offers degree programs in multiple fields by partnering with universities throughout the world. These courses are also accredited by verifiable sources. What you can expect from new, affordable degrees on Coursera: Streamline your path to a bachelor's degree in information technology by easily transferring. Coursera, edX, FutureLearn, Udacity: Are the Certificates and Nanodegrees Worth It? Picture: focalpoint/shutterstock. Many providers of online learning courses. What you can expect from new, affordable degrees on Coursera: Streamline your path to a bachelor's degree in information technology by easily transferring. With performance-based admissions, you can enroll right away into the Master of Engineering degree in Engineering Management. No transcripts or applications are. Overall, yes, they are worth their cost. Whether you're seeking promotion, attempting to switch careers, or just trying to build up more highly sought-after. The expensive degree programs from the universities were featured at the top. But scrolling down, Coursera showed me a bunch of various paths, specializations. While they may not replace a formal degree, Coursera certificates can enhance your resume, showcase your skills, and demonstrate your commitment. Coursera vs the RestIs Coursera Worth It? When Should You Choose It? If you Degrees: Modular degree learning, allowing you to earn your degree from. Coursera Certification - Is it worth it? Yes, I think it is worth it. I learned about and practiced the skills required to be a Data Analyst. Coursera Certification - Is it worth it? Yes, I think it is worth it. I learned about and practiced the skills required to be a Data Analyst. With performance-based admissions, you can enroll right away into the Master of Engineering degree in Engineering Management. No transcripts or applications are. Is Coursera worth it? Yes, Coursera is undoubtedly a worthy e-learning provider with courses from top universities and institutions. Coursera is legit and safe. You can also build credit toward an online degree program by first enrolling in university pre-approved courses, specializations, and certificates on Coursera. It offers benefits like unlimited access to courses, specializations, programs, and professional certificates, but it may not be cost-effective.

Credit Debt Payoff

The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were. How to pay off credit cards in 7 steps · 1. Stop using your credit cards. · 2. Get a realistic fix on your debt. · 3. Begin the month with a budget. · 4. Make. Just input your current card balance along with the interest rate and your monthly payments. We'll help you determine how many months it will take to free. Focus your payments: If you have balances on multiple credit cards, choose one and work to pay it down as quickly as possible. You can choose the avalanche. Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how. You should focus on paying off credit cards with a high interest rate first. The longer you hold on to high-interest debt, the more interest you rack up. Pay off debt faster by refinancing or consolidating to a shorter-term loan or refinance to a lower rate. Contact Wells Fargo to learn about your options. With no emergency savings to draw on during a crisis, you may have to rely on a high-interest credit card or a personal loan to cover the costs. To avoid. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were. How to pay off credit cards in 7 steps · 1. Stop using your credit cards. · 2. Get a realistic fix on your debt. · 3. Begin the month with a budget. · 4. Make. Just input your current card balance along with the interest rate and your monthly payments. We'll help you determine how many months it will take to free. Focus your payments: If you have balances on multiple credit cards, choose one and work to pay it down as quickly as possible. You can choose the avalanche. Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how. You should focus on paying off credit cards with a high interest rate first. The longer you hold on to high-interest debt, the more interest you rack up. Pay off debt faster by refinancing or consolidating to a shorter-term loan or refinance to a lower rate. Contact Wells Fargo to learn about your options. With no emergency savings to draw on during a crisis, you may have to rely on a high-interest credit card or a personal loan to cover the costs. To avoid. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at.

Depending on the amount you owe and your credit rating, many financial institutions will allow you to roll multiple debts into one loan. With just one monthly. There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. Step 1: Make all your minimum payments · Step 2: Build up a cash buffer · Step 3: Capture the full employer match · Step 4: Pay off any credit card debt · Step 5. Use financial windfalls. Commit raises, bonuses or other financial windfalls to debt reduction rather than adding these funds to your monthly spending pool. How to Use This Calculator. For each credit card you have, enter the current balance, the annual percentage rate (APR) and your monthly payment. When you enter. Pay off debt faster by refinancing or consolidating to a shorter-term loan or refinance to a lower rate. Contact Wells Fargo to learn about your options. Ways to pay off credit card debts. · Limit credit card use. · Use a card with no balance for normal purchases. · Open a Huntington Checking Account · Budget. Pay off high-interest debts first. Using a strategy called the debt avalanche method, you make the minimum payments on all your debts and put extra money toward. 5 key strategies to help you get your credit card debt under control · 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card. To pay off $5, in credit card debt within 36 months, you will need to pay $ per month, assuming an APR of 18%. You would incur $1, in interest charges. List your debts and how much you owe, either by hand or in a spreadsheet. You should include both kinds of debt: revolving loans (credit card balances) and. You can also look into credit card debt consolidation, which rolls all your credit card bills into one lower interest monthly payment. The amount you owe will. What to Do · List your credit cards from lowest balance to highest. · Pay only the minimum payment due on the cards with larger balances. · Pay additional on. Pay off credit card debt with The Payoff Loan™. Reduce stress and save with personal loans between $$ with rates as low as % APR built for. In this scenario, the avalanche method would have you pay off your credit card debt first because it has the highest interest rate. If you put your extra money. There are multiple ways to approach paying off credit card debts each month. The Credit Cards Payoff Calculator uses a method known as the "Debt Avalanche. Highlights: While paying off your debts often helps improve your credit scores, this isn't always the case. It's possible that you could see your credit. Payday loans; Revolving, high-interest credit card debt; Personal loans with unfavorable terms; Secured debts. 2. Consider budgeting strategies. Once you'. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Knock out the smallest debt first. Put as much money toward the credit card with the lowest debt while paying only the minimum payment on the others. Once that first debt is paid off, apply that.

All Personal Loans Approved

Loans are provided based on approved credit, income, and identity verification. Not all applicants will qualify. Programs, rates, terms, and conditions are. Follow these steps to apply for a personal loan: 1. Get prequalified. Most – but not all – personal loan companies let you see your estimated interest rate with. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. A Regions personal loan gives you the freedom to cover any expense at a fixed rate. Receive funds quickly in one lump sum and pay the loan back over a. Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all requirements. Not all borrowers receive the lowest rate. Lowest rates reserved for the most creditworthy borrowers. If approved, your actual rate will be within the range of. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. You can get a personal loan from a bank, credit union, or online lender. Online lenders tend to offer the quickest funding, but your bank or credit union may. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. Loans are provided based on approved credit, income, and identity verification. Not all applicants will qualify. Programs, rates, terms, and conditions are. Follow these steps to apply for a personal loan: 1. Get prequalified. Most – but not all – personal loan companies let you see your estimated interest rate with. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. A Regions personal loan gives you the freedom to cover any expense at a fixed rate. Receive funds quickly in one lump sum and pay the loan back over a. Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all requirements. Not all borrowers receive the lowest rate. Lowest rates reserved for the most creditworthy borrowers. If approved, your actual rate will be within the range of. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. You can get a personal loan from a bank, credit union, or online lender. Online lenders tend to offer the quickest funding, but your bank or credit union may. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan.

How to get a personal loan · Know how much you need to borrow. Before deciding to take out a loan at all, decide on the amount. · Review your credit. Before. When beginning your search for a personal loan, be sure to start with your current bank — it may have exclusive perks for existing customers. Other banks to. There are no personal loans with guaranteed instant approval. Many lenders offer the opportunity for near-instant approval, with a decision minutes to hours. What Do I Need for a Personal Loan? · A photo ID, such as a driver's license · Information about a checking or savings account, including routing and account. Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! No Application Fees · Fast Approval Decisions · Competitive Rates & Flexible Terms · Local Decisioning & Faster Processing Time · Free Credit Score & Activity. A personal loan can give you the financial flexibility to take on nearly anything you want to do next in life. Maybe you're ready to start home renovations. Or. Term of Loan. %. Fixed APR. $ Est. Monthly Payment. Continue. Disclaimer & more info. See all offers through LendingPoint. Happy Money. 36 months. 2 You may receive your funds one business day following your acceptance of the loan offer, completion of all necessary verification steps and final approval. Personal loans from Wells Fargo are a great way to manage debt, fund special purchases, or cover major expenses. Apply online. 1. Apply In Minutes. Get customized loan options based on what you tell us. Get the all-in-one app that intelligently saves for you. Or manage your loan like never before. Select an. Get your rate. It takes less than 5 minutes to check your rate—and it won't affect your credit score.¹. Upstart Personal Loan Borrow Amount page ; Get approved. All loan and rate terms are subject to eligibility restrictions, application review, credit score, loan amount, loan term, lender approval, credit usage and. Alternatives to Easy Loans · Banks and credit unions: Local banks and credit unions may offer funding options that you can qualify for, and all you have to do is. A personal loan can be used for a variety of purposes, even for debt consolidation! Try our personal loan calculator to estimate your payments to manage. When you apply for one of our personal loans, we do not limit approval to your credit score. We consider all of your qualifications so that we can offer you a. It also has one of the highest ratings from WalletHub's editors among all personal loan providers, at /5. Key Facts About Discover Personal Loans: Range of. All personal loans have a % to % origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of.

How To Track Bond Yields

Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market. Monitor Tool · Crypto · Blog · Overview · Indices · Indices Futures · Forex · Commodities Bond Yield. %. Trading in financial instruments and/or. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Selected benchmark bond yields are based on mid-market closing yields of selected Government of Canada bond issues that mature approximately in the indicated. Treasury Yields · 1 Month Treasury. US1M. %. %. %. %. %. · 2 Month Treasury. US2M. %. %. %. See Series I Bond Rate History. Separate tables for fixed rates, inflation rates, combined rates. See “I bonds interest rates”. How long does an I bond earn. The Department of Treasury provides daily Treasury Yield Curve rates, which can be used to plot the yield curve for that day. Learn more about bonds. TOOLS &. Corporate bonds fall into two broad categories: investment grade and speculative-grade (also known as high yield or “junk”) bonds. Speculative-grade bonds are. Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. · Price—The higher a bond or CD's price, the lower its yield. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market. Monitor Tool · Crypto · Blog · Overview · Indices · Indices Futures · Forex · Commodities Bond Yield. %. Trading in financial instruments and/or. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Selected benchmark bond yields are based on mid-market closing yields of selected Government of Canada bond issues that mature approximately in the indicated. Treasury Yields · 1 Month Treasury. US1M. %. %. %. %. %. · 2 Month Treasury. US2M. %. %. %. See Series I Bond Rate History. Separate tables for fixed rates, inflation rates, combined rates. See “I bonds interest rates”. How long does an I bond earn. The Department of Treasury provides daily Treasury Yield Curve rates, which can be used to plot the yield curve for that day. Learn more about bonds. TOOLS &. Corporate bonds fall into two broad categories: investment grade and speculative-grade (also known as high yield or “junk”) bonds. Speculative-grade bonds are. Coupon rate—The higher a bond or CD's coupon rate, or interest payment, the higher its yield. · Price—The higher a bond or CD's price, the lower its yield.

The yield of a bond is also based on the price paid for the bond, its coupon and its term-to-maturity. Rising interest rates affect bond prices because they. Terrorist Finance Tracking Program · Money Laundering · Financial Action Task Treasury Coupon-Issue and Corporate Bond Yield Curve · Treasury Coupon. Bond yield refers to the rate of return or interest paid to the bondholder while the bond price is the amount of money the bondholder pays for the bond. Now. WB World Bond Markets allows you to monitor and chart sovereign (government) bond yields, BTMM Treasury and Money Markets displays all major rates. The Treasury Yield Curve Tracker is a simple app that allows users to view and analyze the current shape of the US treasury yield curve. The app offers a. As of AM ET 09/09/ Yields may be delayed up to 15 minutes. The S&P ® Bond Index is designed to be a corporate-bond S&P Dow Jones Indices Launches First of Its Kind Index Tracking the Debt of the S&P ® Companies. U.S. 5 Year Treasury Note, %, ; U.S. 7 Year Treasury Note, %, ; U.S. 10 Year Treasury Note, %, ; U.S. 30 Year Treasury Bond, %. WB World Bond Markets allows you to monitor and chart sovereign (government) bond yields, BTMM Treasury and Money Markets displays all major rates. Government Bond Yield Curve ; , , ; , , ; , , ; , , Simple, easy to use app to track US Bond market rates. Displays rates/yield for US Treasury Bonds, Municipal Bonds and Corporate Bonds in separate sections. The yield curve – also called the term structure of interest rates – shows the yield on bonds over different terms to maturity. The 'yield curve' is often used. Bond Watchlist. Subscription information on historic transaction-level data on all transactions in corporate bonds reported to TRACE available solely to. High-yield corporate bonds; International developed market bonds; Emerging-market bonds; Preferred securities. U.S. Treasuries. Oops looks like chart could not be displayed! · Yield Open% · Yield Day High% · Yield Day Low% · Yield Prev Close% · Price · Price Change+. The latest international government benchmark and treasury bond rates, yield curves, spreads, interbank and official interest rates Monitor a select list of. US 10 Year Note Bond Yield was percent on Monday September 9, according to over-the-counter interbank yield quotes for this government bond maturity. Last trading activity. Track Treasury Yields. Stay up-to-date on yield curve trends. Bonds' interest rates, also known as the coupon rate, can be fixed, floating, or only payable at maturity. The most common interest rate is a fixed rate until. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve.

I Want To Take Equity Out Of My House

Refinance with cash out Refinancing with cash out involves taking out a new mortgage for the current value of your house to pay off your old mortgage and. Take your home's value, and then subtract all amounts owed on that property. The difference is the amount of equity you have. Visit Citizens to learn more. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates. When taking out a home equity loan, you must repay the loan in its entirety, including interest. It's important to weigh the pros and cons of using equity from. In this case, you borrow more than is owed on the house. You might still owe $80, on the mortgage. But with a cash-out refinance you borrow $, The. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. Home equity loans are popular for homeowners with an immediate need for the entire balance, such as a medical emergency. Though you can get a home equity loan. Refinance with cash out Refinancing with cash out involves taking out a new mortgage for the current value of your house to pay off your old mortgage and. Take your home's value, and then subtract all amounts owed on that property. The difference is the amount of equity you have. Visit Citizens to learn more. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates. When taking out a home equity loan, you must repay the loan in its entirety, including interest. It's important to weigh the pros and cons of using equity from. In this case, you borrow more than is owed on the house. You might still owe $80, on the mortgage. But with a cash-out refinance you borrow $, The. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. Cash-out refinancing, which replaces your current mortgage loan with a larger one and gives you the difference in cash. The more equity you have, the more cash. Home equity loans are popular for homeowners with an immediate need for the entire balance, such as a medical emergency. Though you can get a home equity loan.

Getting funding through a home refinance involves updating your current home mortgage, adjusting the interest rates or terms of the loan and taking out cash at. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your. Equity release options · Lifetime mortgage: you take out a mortgage secured on your property provided it's your main residence, while retaining ownership. · Home. You can get cash from your home's equity with a HELOC, home equity loan, or a cash out refinance. Learn the pros and cons of these loan choices! This can be done through a home equity loan, a home equity line of credit (HELOC), or by refinancing your mortgage. If you take out a home. It's possible to use a home equity loan to pay off your mortgage, but you'll want to make sure it's the right move for you. money, and why you're taking out. You can cash out your equity in a home by refinancing your current home loan. Some banks will decline your application due to the amount of equity you want. You can use the money from a home equity loan or cash-out refinance as a down payment on this second property. Is a HELOC or home equity loan a good idea? A HELOC can be used for any type of expense, including home renovations, buying a second home or investment property, paying for college tuition, and paying-off. Releasing equity means taking some of the equity you have built up in a property and turning it back into money. Your percentage of equity reduces but you have. When it comes to getting equity from your house, one of the most common methods is to refinance your home loan. But other options are available to homeowners. But this approach is fraught with risks, especially the risk that you could lose your primary home. When you take out a home equity loan to buy a second house. Home equity loans allow homeowners to borrow against the equity in their homes. The loan amount is based on the difference between the home's current market. A HELOC can be used for any type of expense, including home renovations, buying a second home or investment property, paying for college tuition, and paying-off. How does equity release work? Equity release works by borrowing cash against the value of your home. There are two ways to do this – a lifetime mortgage and a. A home equity loan allows you to cash out up to 80% of the value of the home (minus mortgage balance). While it is possible to use that money to fund the. In this case, you borrow more than is owed on the house. You might still owe $80, on the mortgage. But with a cash-out refinance you borrow $, The. Before taking out a home equity loan or HELOC, it's important to understand the risks. Because you're putting your home up as collateral, you could potentially. But this approach is fraught with risks, especially the risk that you could lose your primary home. When you take out a home equity loan to buy a second house. With a HELOC, you're borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your.

Shilajit For Premature Ejaculation

Shilajit Gold doesnt help in erectile dysfunction or premature ejaculation. overall no changes seen in body. no benefits. so dont waste your money. Shilajit Gold Capsule is an ayurvedic medicine that is primarily used for the treatment of Low Libido in Men,Low Sexual Vitality,Sexual anorexia,Low Sperm. (Thiyagarajan and Sunderrajan, ). Shilajit is often tagged as 'rasayana' of traditional Ayurvedic and Siddha systems of medicine that has attracted the. It's also known as Shukragata Vata in Ayurveda. It means that a man is unable to delay ejaculation during sexual activity, which can cause dissatisfaction for. Good formula to increase testosterone level in men Not as much effective in Erectile Dysfunction or Premature ejaculation Best for improving immunity. Shilajit is known to boost libido and energy levels which is why it features as a top herb for sexual health problems. It is a rich source of fulvic acid, has antioxidant properties, and contains 80+ trace minerals. The Kapiva Himalayan Shilajit comes in a resin form with a. It's also known as Shukragata Vata in Ayurveda. It means that a man is unable to delay ejaculation during sexual activity, which can cause dissatisfaction for. Does Shilajit Help in Premature Ejaculation | Sex Stamina | Shilajit Ke Fayde Aur Nuksan Shilajit resin is a supplement common in ayurvedic. Shilajit Gold doesnt help in erectile dysfunction or premature ejaculation. overall no changes seen in body. no benefits. so dont waste your money. Shilajit Gold Capsule is an ayurvedic medicine that is primarily used for the treatment of Low Libido in Men,Low Sexual Vitality,Sexual anorexia,Low Sperm. (Thiyagarajan and Sunderrajan, ). Shilajit is often tagged as 'rasayana' of traditional Ayurvedic and Siddha systems of medicine that has attracted the. It's also known as Shukragata Vata in Ayurveda. It means that a man is unable to delay ejaculation during sexual activity, which can cause dissatisfaction for. Good formula to increase testosterone level in men Not as much effective in Erectile Dysfunction or Premature ejaculation Best for improving immunity. Shilajit is known to boost libido and energy levels which is why it features as a top herb for sexual health problems. It is a rich source of fulvic acid, has antioxidant properties, and contains 80+ trace minerals. The Kapiva Himalayan Shilajit comes in a resin form with a. It's also known as Shukragata Vata in Ayurveda. It means that a man is unable to delay ejaculation during sexual activity, which can cause dissatisfaction for. Does Shilajit Help in Premature Ejaculation | Sex Stamina | Shilajit Ke Fayde Aur Nuksan Shilajit resin is a supplement common in ayurvedic.

Premature ejaculation (PE), is the condition where a man finishes a sexual act earlier than his partner. Generally it refers to ejaculation by the male within. There are a few ayurvedic tips and home remedies for premature ejaculation that may help people who are suffering from the problem of premature ejaculation. Sudh Shilajit Powder is the best ayurvedic sex power medicine. It cures all the sexual problem. Give long timing sex and it is pleasurable. Dear friends in this video we are going to discuss about Shilajit capsules to cure premature ejaculation and erection problems in men. You can find. Men who consume shilajit have a higher sperm count and sperm motility. Benefits of Shilajit for Male | Premature Ejaculation | Erectile Dysfunction. We offer ayurvedic capsules for premature ejaculation that provide a natural and holistic approach to this common concern. How effective is Shilajit for premature ejaculation? It has gained a reputation for this, but dive into the facts here. Shilajit is an important drug listed in the Ayurvedic Materia medica and is extensively used by Ayurvedic physicians for managing a range of diseases. You have been using the wrong medications for treating premature ejaculation (premature ejaculation). Both the ones you've mentioned are indicated for ere. Shilajit: Known for its rejuvenating properties, shilajit is commonly used in Ayurvedic medicines for sexual myyalta.ru, Alpha Arogya offers. Order SMW'S SHILAJIT PLUS POWER LUSH CAPSULES ERECTILE DYSFUNCTION AND PREMATURE EJACULATION 30 CAPSULES online & get upto 60% OFF on PharmEasy. Shilajit Gold is a premium Ayurvedic formulation for men. It improves strength, stamina, power and beneficial in relieving general weakness. Buy pure himalayan shilajit gold supplements for men & women. This includes ashwagandha, safed musli, amlaki, salampanja etc to improve performance. Dabur Shilajit  is an Ayurvedic formulation which helps improve strength; stamina and power. It is also well-known for improving muscle strength; repair and. Buy Zenius Shilajeet Capsule | Stamina booster capsule for men - shilajit capsule - premature ejaculation capsules online. Shop from our wide range of items. Dabur Shilajit Gold - 20 Capsules | % Ayurvedic Capsules for Strength, Stamina and Power | Premium Ayurvedic Supplement | For Men: myyalta.ru: Health. There is a certain group of guys that experience Delayed Ejaculation/Diminished sensation and other sexual effects from using Shilajit. Get rid of erectile dysfunction, premature ejaculation and vaginal Shilajit Resin (option 1, Rs /20g) - myyalta.ru Shilajit Gold Capsule is an Ayurvedic formulation that helps improve strength, stamina and power. Shilajit Capsule helps in relieving general weakness and.

Acer Ransomware

Reports say a ransomware gang has given Acer until March 28 to pay, or it will double the ransom amount. "Computer giant Acer hit by $50 million ransomware attack". BleepingComputer. Retrieved ^ "Ransomware hackers steal plans for upcoming Apple. Reports say a ransomware gang has given Acer until March 28 to pay, or it will double the ransom amount. Acer reportedly targeted with $50 million ransomware attack myyalta.ru Security-Breach-Investigation-e Ransomware. Acer confirms second security breach this year. 15 October No comments. Save article. Acer has been hit by a REvil ransomware attack through a Microsoft Exchange vulnerability. The ransomware operators demanded $50 million in ransom. Acer Reportedly Hit With $50M Ransomware Attack. Acer Reportedly Hit With $50M Ransomware Attack. Reports say a ransomware gang has given Acer until March 28 to. A hacker group known as REvil is said to be responsible for the breach. The attackers reportedly gained access to Acer's network through a Microsoft. The Sodinokibi/REvil ransomware gang has reportedly infected Taiwanese multinational electronics corporation Acer and demanded a ransom of $50 million. Reports say a ransomware gang has given Acer until March 28 to pay, or it will double the ransom amount. "Computer giant Acer hit by $50 million ransomware attack". BleepingComputer. Retrieved ^ "Ransomware hackers steal plans for upcoming Apple. Reports say a ransomware gang has given Acer until March 28 to pay, or it will double the ransom amount. Acer reportedly targeted with $50 million ransomware attack myyalta.ru Security-Breach-Investigation-e Ransomware. Acer confirms second security breach this year. 15 October No comments. Save article. Acer has been hit by a REvil ransomware attack through a Microsoft Exchange vulnerability. The ransomware operators demanded $50 million in ransom. Acer Reportedly Hit With $50M Ransomware Attack. Acer Reportedly Hit With $50M Ransomware Attack. Reports say a ransomware gang has given Acer until March 28 to. A hacker group known as REvil is said to be responsible for the breach. The attackers reportedly gained access to Acer's network through a Microsoft. The Sodinokibi/REvil ransomware gang has reportedly infected Taiwanese multinational electronics corporation Acer and demanded a ransom of $50 million.

According to Bleeping Computer, hackers have accessed Acer documents that include financial spreadsheets, bank balances and bank communications, reportedly. Taiwanese tech giant Acer is the latest company to fall victim to relentless hackers. What makes the Acer breach especially noteworthy is the fact that the. Reports are strongly suggesting that Acer has been hit with a huge ransomware attack with a $50M demand for the release of the encrypted data being set! Press & Media. Experts Reaction On Computer Giant Acer Hit By $50 Million Ransomware Attack. Richard Hughes March • 6 min read. Protect your laptop, tablet, and phones all from one account. Awards. Award-winning antivirus. Protection against the latest malware, virus, and ransomware. In fact, the ransom demanded was a whopping $50,,! If hackers can exploit Acer, small and mid-sized firms need to be even more cautious. Data breaches won. Acer. Taiwanese computer giant Acer was hit by a REvil ransomware attack in March this year. The hackers demanded a whopping $50 million. They shared images. Acer has faced an attack from ransomware from a member of our staff accidentally clicking on a phishing mail, and we may face similar attacks in the future. To. They also demanded $50 million from Acer, an amount which was the largest ransom ask made of any victim at that time. Apple Ransomware Attack – April Hacker group Desorden announced on a popular hacker forum that it has hacked and breached the Taiwanese multinational hardware and electronics company Acer. Acer has faced an attack from ransomware from a member of our staff accidentally clicking on a phishing mail, and we may face similar attacks in the future. To. The Sodinokibi/REvil ransomware gang has reportedly infected Taiwanese multinational electronics corporation Acer and demanded a ransom of $50 million. Acer, one of the world's largest PC and device makers, has reportedly been targeted by the ransomware gang REvil, aka Sodinokibi, according to published. The Taiwanese computer manufacture Acer have been targeted by the REvil ransomware group, with hackers demanding $50 million, the largest ransom on record. Hackers Seeking Big Ransomware Payday By Attacking Acer Computers. Posted by ComTech Computer Services, Inc. On April 9, Share. Taiwanese tech giant. The REvil/Sodinokibi ransomware group has reportedly targeted computer manufacturer Acer with a $50 million ransomware attack — and its ransom demand may grow. Reports are strongly suggesting that Acer has been hit with a huge ransomware attack with a $50M demand for the release of the encrypted data being set! On the 18th of March , the infamous ransomware gang, REvil announced on their data leak site that they had breached Acer. Acer has confirmed a 60GB data breach resulting from a cyber attack on its Indian offices - the second major breach to affect the global hardware and. They also demanded $50 million from Acer, an amount which was the largest ransom ask made of any victim at that time. Apple Ransomware Attack – April

Upstart Short Squeeze

Fintel® · Login; Features. PREMIUM · Quant Models · Options Flow · Dividend Calendar · Short Squeeze Upstart Holdings, Inc. NASDAQ. (%). Last. UPST Short Squeeze Could be a dead cat. But the RR is great. UPST is currently under attack my shorts, and they have been BURNED by this stock. Nevertheless. Upstart is a cloud-based artificial intelligence (AI) lending platform founded in The share price peaked at around $ in late Track Upstart Holdings Inc (UPST) Stock Price, Quote, latest community messages, chart, news and other stock related information. Upstart Holdings (UPST) has M shares short, which is % of float and times average daily trading volume. Short Sellers Love Upstart Holdings After 38% Gain. UPST Published: July 18 Short-squeeze stocks have seen an explosion in interest after the recent. These are the companies with the largest proportions of shares available for trading currently sold short Upstart Holdings Inc. $, %. %. Dividend Date N/A; Short Interest M 07/31/24; % of Float Shorted %; Average Volume M. Performance. 5 Day. %. 1 Month. %. 3 Month. %. Upstart Holdings Inc. - Common stock, $ UPST, Short Interest Ratio (Days To Cover), Short Interest (Shares Short), 24,, Short Squeeze. Fintel® · Login; Features. PREMIUM · Quant Models · Options Flow · Dividend Calendar · Short Squeeze Upstart Holdings, Inc. NASDAQ. (%). Last. UPST Short Squeeze Could be a dead cat. But the RR is great. UPST is currently under attack my shorts, and they have been BURNED by this stock. Nevertheless. Upstart is a cloud-based artificial intelligence (AI) lending platform founded in The share price peaked at around $ in late Track Upstart Holdings Inc (UPST) Stock Price, Quote, latest community messages, chart, news and other stock related information. Upstart Holdings (UPST) has M shares short, which is % of float and times average daily trading volume. Short Sellers Love Upstart Holdings After 38% Gain. UPST Published: July 18 Short-squeeze stocks have seen an explosion in interest after the recent. These are the companies with the largest proportions of shares available for trading currently sold short Upstart Holdings Inc. $, %. %. Dividend Date N/A; Short Interest M 07/31/24; % of Float Shorted %; Average Volume M. Performance. 5 Day. %. 1 Month. %. 3 Month. %. Upstart Holdings Inc. - Common stock, $ UPST, Short Interest Ratio (Days To Cover), Short Interest (Shares Short), 24,, Short Squeeze.

A short squeeze occurs when there's a rapid and significant increase in the price of a stock that has been heavily shorted. It puts pressure on short sellers to. Overall, the positive earnings report, short squeeze potential, and market speculation regarding potential acquisitions likely fueled UPST's bullish movement. GameStop Corp. (GME); Beyond Meat (BYND); Skillz (SKLZ); Virgin Galactic Holdings (SPCE); Upstart Holdings (UPST). Short squeezes are happening!Discussing some potential short squeeze candidates. Some of these names have already bolstered huge gains and looking to. A short squeeze for Upstart occurs when it has a large amount of short interest and its stock appreciates in price. This forces short sellers to cover their. Strong Buy Stocks - Short Squeeze · Top REITs · ETF Screener Collapse menu. All Upstart Can Move Higher On Short Interest, Efficiency Gains · Kevin George. Upstart Holdings Inc (UPST) was the most shorted stock with a %SOOL of Short squeeze score - Proprietary model utilizing transaction level data to. Upstart $UPST remains my top short-squeeze candidate for So many similarities to Tesla in Once the Model 3 ramped, $TSLA's stock. UPST Short Squeeze Could be a dead cat. But the RR is great. UPST is currently under attack my shorts, and they have been BURNED by this stock. Nevertheless. Find the latest on short interest, settlement dates, average share volume, and days to cover for Upstart Holdings, Inc. Common stock (UPST) at myyalta.ru Upstart Holdings, Inc. (UPST) With a recent earnings beat and a high short interest, shares have short squeeze potential over the next few months. 3 Stocks That Could Skyrocket in a Massive Gamma Short Squeeze. (InvestorPlace). May AM · Should Investors Buy Upstart Stock Right Now? (Motley Fool). AMC Entertainment Holdings (AMC) · GameStop Corp. (GME) · Beyond Meat (BYND) · Skillz (SKLZ) · Virgin Galactic Holdings (SPCE) · Upstart Holdings . Stocks with high short interest are often very volatile and are well known for making explosive upside moves (known as a short squeeze). Upstart Holdings Inc. Short interest for Upstart Hldgs gives investors a sense of the degree to which investors are betting on the decline of Upstart Hldgs's stock. Short interest in Upstart is high, potentially leading to a short squeeze that could dr 2 days ago - Seeking Alpha. Stay informed in just 2 minutes. Get a. Short Squeeze Stocks Alert: 4 Stocks Goldman Thinks Can Surge Higher. InvestorPlace • 08/08/ Upstart earnings: What to expect from the AI lender. Market. Could a Short Squeeze Be Coming for These 3 Heavily Shorted Stocks? The Motley Fool • 11/15/ Why Upstart, Redfin, and Truist Stocks Are All Surging Higher. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Upstart Holdings 3 Short-Squeeze Stocks to Buy Hand over Fist in June .

Buying A Home With Ira Money

No, using an IRA property for a second home isn't allowed. Although real estate can be held in an IRA, it must be for investment purposes. This means the. BUYING THE PROPERTY – Checkbook IRA · Find the desired investment and negotiate the purchase. · If financing is necessary the loan must be to the IRA LLC and non-. Purchasing real estate within an IRA usually requires paying in cash, and the IRA must pay all ownership expenses. Holding real estate in your IRA can be. You'll have to pay income tax on the amount withdrawn, and you must use the funds within days of their distribution. Withdrawing From a Roth IRA. Roth IRAs. Simple IRA ; A first-time home purchase (up to $10,); A birth or adoption expense (up to $5,); A qualified education expense ; Electronic funds transfer . 1. Can I use funds from my IRA to renovate property to sell it at a higher price? Yes. · 2. I plan to purchase a rental property with my IRA. · 3. Can my IRA. If both you and your spouse are both first-time home buyers (and you both have IRAs), each of you can withdraw up to $10, without having to pay the 10%. If your IRA bought the property outright, you do not owe unrelated business income tax (UBIT). Rent and the gains from property sold by an IRA outright are. If it's a Roth you can pull it out tax free & penalty free for a first time home purchase. Up to a 10k in earnings. No, using an IRA property for a second home isn't allowed. Although real estate can be held in an IRA, it must be for investment purposes. This means the. BUYING THE PROPERTY – Checkbook IRA · Find the desired investment and negotiate the purchase. · If financing is necessary the loan must be to the IRA LLC and non-. Purchasing real estate within an IRA usually requires paying in cash, and the IRA must pay all ownership expenses. Holding real estate in your IRA can be. You'll have to pay income tax on the amount withdrawn, and you must use the funds within days of their distribution. Withdrawing From a Roth IRA. Roth IRAs. Simple IRA ; A first-time home purchase (up to $10,); A birth or adoption expense (up to $5,); A qualified education expense ; Electronic funds transfer . 1. Can I use funds from my IRA to renovate property to sell it at a higher price? Yes. · 2. I plan to purchase a rental property with my IRA. · 3. Can my IRA. If both you and your spouse are both first-time home buyers (and you both have IRAs), each of you can withdraw up to $10, without having to pay the 10%. If your IRA bought the property outright, you do not owe unrelated business income tax (UBIT). Rent and the gains from property sold by an IRA outright are. If it's a Roth you can pull it out tax free & penalty free for a first time home purchase. Up to a 10k in earnings.

How to withdraw from IRA for Home Purchase. If you qualify to make a hardship withdrawal, you can make a withdrawal from your IRA to purchase a new house. You. Yes, the IRS considers buying a home to be a “hardship.” Hardship withdrawals are subject to income tax and the 10% early withdrawal penalty. You'll have to. As we learned in this post, you can use your IRA to purchase real estate as an investment. We know that IRAs are legal entities apart from their owners. Instead, you need to prove a consistent monthly income from your various retirement funds. You'll also need to prove that you'll continue to receive certain. You can use the money you've invested in a retirement account, such as a (k) or IRA, to help purchase a home. Yes, the IRS considers buying a home to be a “hardship.” Hardship withdrawals are subject to income tax and the 10% early withdrawal penalty. You'll have to. IRA can be used to buy real estate, you just need to have it setup properly (hint: can use Fidelity IRA for that). Real estate can grow tax-free inside of a. The easiest way to use your Roth IRA to purchase a home is to make a withdrawal from your account. Qualified Roth IRA withdrawals are tax and penalty-free if. Generally, you can withdraw funds from your IRA to purchase a home without incurring the usual early withdrawal penalty. However, there are specific conditions. As we learned in this post, you can use your IRA to purchase real estate as an investment. We know that IRAs are legal entities apart from their owners. As one of the other answers mentioned, one way to do so is to buy units of REITs (real estate investment trusts). If your Roth IRA is set up as. Typically if you withdraw money out of your Traditional IRA prior to age 59 you have to pay ordinary income tax and a 10% early withdrawal penalty on the. Funds from the IRA are sent to closing for the purchase and the IRA takes title to the property directly. Tenants-in-Common with a partner entity - This is one. Thanks to the Taxpayer Relief Act, first-time homebuyers can use their IRA funds to purchase their dream home. Of course, perform your due diligence before. You can Use Your Individual Retirement Funds to Buy a Home. Did you know that you are within your rights to purchase a home with your IRA? Along with using your. Yes, the funds would be distributed back into the IRA. This allows you the option of purchasing more assets within your IRA. What are the requirements for IRA. This would be considered a prohibited transaction (see IRC ). You many not purchase property which is currently owned by you or any other disqualified. The process to purchase real estate using my IRA savings is fairly simple and after flipping the property, all profits remain in the IRA account without capital. Unfortunately, there is no such thing as an IRA loan. The only way to take money out of an IRA is through a withdrawal. If you are buying your first house. Generally, the 10% penalty applies when money is distributed from an IRA before age 59 ½. Money withdrawn from an IRA is still taxable at ordinary income tax.