myyalta.ru

Categories

How Do You Invest In Apple

How to buy Apple stock & shares to invest in AAPL · Apple stock is traded on the Nasdaq stock exchange under the AAPL ticker. · AAPL currently makes up about 6%. Invest in Apple, myyalta.ru and other US listed companies from outside US. Easy onboarding, no account minimums, secure and simple stock investing. 1 Enter the amount you'd like to invest in Apple stock, then proceed to checkout. · 2 Choose a Stash plan and set up your investment account in just a few. Apple Inc engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of related. You can buy shares of Apple in any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Apple Inc. · Price Momentum. AAPL is trading near the top of its week range and above its day simple moving average. · Price change. The price of AAPL. One can easily invest in Apple Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification. Apple trading hours · Pre-market trading hours from to · Market hours from to · After-market hours from to One can easily invest in Apple Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification. How to buy Apple stock & shares to invest in AAPL · Apple stock is traded on the Nasdaq stock exchange under the AAPL ticker. · AAPL currently makes up about 6%. Invest in Apple, myyalta.ru and other US listed companies from outside US. Easy onboarding, no account minimums, secure and simple stock investing. 1 Enter the amount you'd like to invest in Apple stock, then proceed to checkout. · 2 Choose a Stash plan and set up your investment account in just a few. Apple Inc engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of related. You can buy shares of Apple in any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Apple Inc. · Price Momentum. AAPL is trading near the top of its week range and above its day simple moving average. · Price change. The price of AAPL. One can easily invest in Apple Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification. Apple trading hours · Pre-market trading hours from to · Market hours from to · After-market hours from to One can easily invest in Apple Inc shares from India by: Direct Investment - Opening an international trading account with Groww which includes KYC verification.

What does that look like on a brokerage statement? Check out the above chart and you'll see that if you invested $1, in Apple stock 20 years ago, it would. Yes, Indian Investors can invest in the Apple, Inc. (AAPL) Share by opening an international trading account with Angel One. How can I purchase Apple, Inc. In this article, we will provide a step-by-step guide on how to buy Apple stock, including creating an account on eToro, choosing the appropriate order type. Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Buy Apple stock from these online trading platforms. Compare special offers, low fees and a wide range of investment options among top trading platforms. 1. Sign up for a brokerage account on Public. It's easy to get started. · 2. Add funds to your Public account · 3. Choose how much you'd like to invest in Apple. To buy AAPL shares in Australia, you'll need to open an account with an investing platform that offers the security. Try Stake, you can sign up in minutes. Fund. However, you can buy Apple stock through a brokerage account. How much money do you need to buy Apple stock? +. As of. Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. Apple Inc has relatively low volatility with skewness of and kurtosis of Understanding different market volatility trends often help investors to. This app is available only on the App Store for iPhone, iPad, and Apple Watch. myyalta.ru: Stock Market 4+. Real time stocks data. Invest in Apple, NASDAQ: AAPL Stock - View real-time AAPL price charts. Online commission-free investing in Apple: buy or sell Apple Stock commission-free. Newsroom · Apple Sports is ready for football season · Apple announces Chief Financial Officer transition · Apple and 4-H are bringing technology to a new. This article provides a definitive guide to investing in Apple, the specific options available to investors, and the processes involved in each option. Apple trading hours are the time when investors can buy and sell shares of Apple (#S-AAPL). Apple's stock is traded on multiple exchanges around the world. Why Robinhood? Robinhood gives you the tools you need to put your money in motion. You can buy or sell Apple and other ETFs, options, and stocks. Access real-time $Apple stock insights on eToro. ➤ View prices, charts, and analyst price target ✓ Invest in AAPL Now. Use the Stocks app on Apple Watch to see info on the stocks you follow on your iPhone. See the iPhone User Guide for more information. Apple briefly became the world's first $3 trillion company during intraday trading on Jan. 3, The iPhone maker also holds the distinction of being the. Use the Stocks app on your iPhone, your iPad, your Apple Watch and your Mac. Add Stocks widgets to your Home Screen or Lock Screen to see price quotes at a.

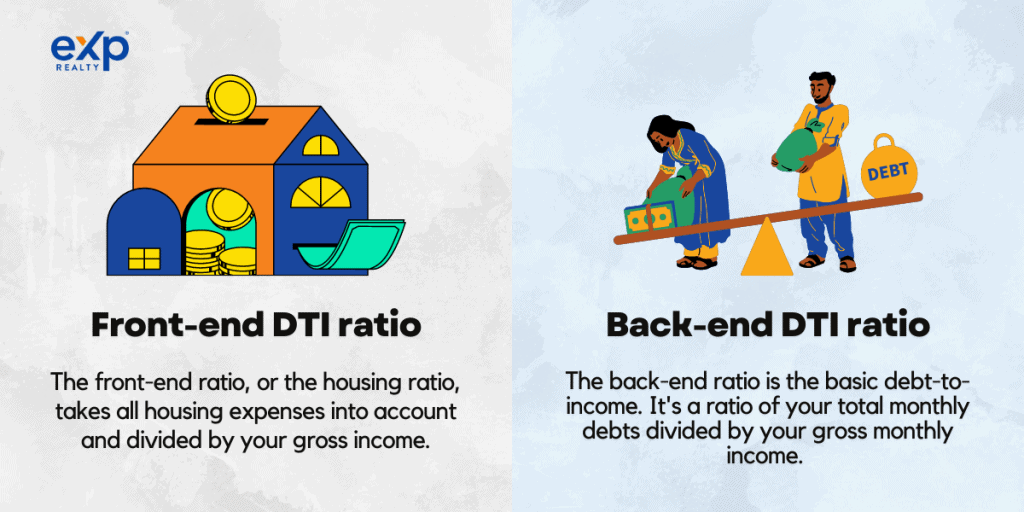

Front End Dti

The back-end ratio is a measure that signifies the portion of monthly income used to settle debts. Lenders, such as bondholders or issuers of mortgages, use the. One of the most important acronyms in the mortgage and real estate industry is DTI (Debt-To-Income). Learn what DTI is, and why it's important in. The front-end ratio includes not only rental or mortgage payment, but also other costs associated with housing like insurance, property taxes, HOA/Co-Op Fee. Back-End Ratio: A back-end DTI ratio of 36% or lower is often considered ideal. This ratio indicates that your overall debt burden is manageable and that you. According to official FHA guidelines, borrowers are generally limited to having debt ratios of 31% on the front end, and 43% on the back end. But the back-end. The front end DTI is one of the two types of DTI ratios, and it focuses solely on your housing expenses. This includes your monthly mortgage payment, property. Graph and download economic data for Large Bank Consumer Mortgage Originations: Original Front-End Debt-to-Income (DTI): 75th Percentile (RCMFLOFEDTIPCT75). For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be exceeded up to 45% if. The standard maximum front end DTI for conventional loans is 28 percent. When you apply for a new loan with a standard percent down payment, the lender. The back-end ratio is a measure that signifies the portion of monthly income used to settle debts. Lenders, such as bondholders or issuers of mortgages, use the. One of the most important acronyms in the mortgage and real estate industry is DTI (Debt-To-Income). Learn what DTI is, and why it's important in. The front-end ratio includes not only rental or mortgage payment, but also other costs associated with housing like insurance, property taxes, HOA/Co-Op Fee. Back-End Ratio: A back-end DTI ratio of 36% or lower is often considered ideal. This ratio indicates that your overall debt burden is manageable and that you. According to official FHA guidelines, borrowers are generally limited to having debt ratios of 31% on the front end, and 43% on the back end. But the back-end. The front end DTI is one of the two types of DTI ratios, and it focuses solely on your housing expenses. This includes your monthly mortgage payment, property. Graph and download economic data for Large Bank Consumer Mortgage Originations: Original Front-End Debt-to-Income (DTI): 75th Percentile (RCMFLOFEDTIPCT75). For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be exceeded up to 45% if. The standard maximum front end DTI for conventional loans is 28 percent. When you apply for a new loan with a standard percent down payment, the lender.

What are the real world numbers a lender will accept for front end dti ratio? ; deepayes · 4 · 4K77 ; [deleted] · 2 · [deleted] ; GoForBrok3 · 1 · 4K Front-End DTI (Debt-to-Income) and Back-End DTI are two important financial ratios used by lenders to assess a borrower's ability to manage debt. Both of which. Calculate your front-end DTI ratio by dividing your housing payments by your monthly income. Calculate your back-end DTI ratio by dividing your total of all. What is a good debt-to-income ratio? · Front-end ratio: Sometimes referred to as the “housing ratio,” your front-end ratio refers to what part of your income. To calculate your DTI, add up all of your monthly debt payments, then divide by your monthly income. DTI = Monthly debts / monthly income. Here's how. The ideal front-end and back-end ratios should be lower than 28% and 36%, respectively. However, a loan approval does not solely depend on this ratio. Mortgage. When comparing DTI's lenders use two different metrics. A front end and a back end calculation using two different metrics. Lenders typically like to see %. For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be exceeded up to 45% if. Define Front-End DTI Ratio. means with respect to a Loan, the ratio of (i) the Mortgagor's monthly housing-related debt payments, to (ii) the Mortgagor's. The back-end DTI consists of your monthly housing payment plus all other monthly debt, such as your car payment or credit card balance. Here's how to calculate. Conventional max DTI is 45/45 (same front and back-end, which means your housing debt can be 45% of your monthly gross income). What Is a Good Debt-to-Income Ratio? Your front- and back-end ratios matter when applying for a mortgage because they can indicate your ability to keep up. The front end DTI is one of the two types of DTI ratios, and it focuses solely on your housing expenses. This includes your monthly mortgage payment, property. Front-End Ratio (FER). 43%. Debt to Income. Ratio (DTI) / Back-End Ratio. Total Monthly Debt*/ Gross Monthly. Income x = DTI. *Total Monthly Debt includes. Back-end DTI allows your lender and you to consider how your monthly debts might be affected by adding in a mortgage. How to Calculate DTI. Before getting a. Front-End DTI (Debt-to-Income) and Back-End DTI are two important financial ratios used by lenders to assess a borrower's ability to manage debt. Both of which. If a homeowner has a mortgage, the front-end DTI ratio is usually calculated as housing expenses (such as mortgage payments, mortgage insurance, etc.) divided. Calculate Your Debt to Income Ratio. Use this worksheet to figure your debt to income ratio. Generally speaking, a debt ratio greater than or equal to 40%. Back-end DTI ratio Back-end debt includes two separate totals. The first is the total of all monthly payments in the categories that appear on a credit report. Using the same method as above, you can easily calculate back-end DTI by dividing your total monthly debt (recurring expenses only), by your gross monthly.

Do You Get Paid Donating Plasma

New Plasma Donors Can Earn Over $ During the First 35 Days! In addition to getting paid for each plasma donation, you can make even more money during. Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. Funds can be withdrawn. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers. With as few as two plasma donations, you can redeem points for electronically delivered gift cards to restaurants, movie theaters, retailers and more. Learn. Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. You'll typically be paid between $20 and $60 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. Each plasma collection facility sets its own compensation rates. Find a Donor Center. Plasma donors save lives everyday! Here's a rewarding opportunity to help someone battling illness and disease, such as cancer or an autoimmune condition. Specialized Donor Program. Need money now? We compensate every donor for the time they dedicate for each donation, since the process required can take anywhere from 1 to 2 hours. New Plasma Donors Can Earn Over $ During the First 35 Days! In addition to getting paid for each plasma donation, you can make even more money during. Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. Funds can be withdrawn. It's $50 for the first donation of the week and $65 for the second donation of the week. That's $ a month, not counting any special offers. With as few as two plasma donations, you can redeem points for electronically delivered gift cards to restaurants, movie theaters, retailers and more. Learn. Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. You'll typically be paid between $20 and $60 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. Each plasma collection facility sets its own compensation rates. Find a Donor Center. Plasma donors save lives everyday! Here's a rewarding opportunity to help someone battling illness and disease, such as cancer or an autoimmune condition. Specialized Donor Program. Need money now? We compensate every donor for the time they dedicate for each donation, since the process required can take anywhere from 1 to 2 hours.

Yes! When you donate plasma and platelets with PlasmaSource, you can donate your payment to a nonprofit, charity, or cause of your choice. How often. Comments51 ; Is Donating Plasma Worth It? (). Your Driver Mike · K views ; 5 Side Hustles To Help You Get Out Of Debt. The Ramsey Show. You will need to visit a plasma collection center to determine if you are eligible to donate. In general: Plasma donors should be at least 18 years old. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive up to. People do indeed get paid for blood and plasma. Plasma is the item most often paid for because obtaining it is time-consuming. People's time is. Because plasma is such a precious resource and because we know that giving takes both time and effort, our KEDREWARDS program offers compensation for donations. If you don't receive a Form MISC, you are still required to report income earned from plasma donation on your tax return. Keep accurate records of your. New Donors Can Earn Hundreds During Their First 35 Days At Our Local Plasma Donation Centers! In addition to getting paid for your time, you can also make. By donating your specialty plasma for Plasma Services Group, you can get paid to make a difference! PSG pays qualified donors a minimum of $ per plasma. It takes only a few minutes longer than donating blood but can have a profound impact. Donors with type AB blood make ideal candidates for AB Elite plasma or. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. After each successful donation, you will be paid between $$60 in NYC and between $$ in Florida. We hope to see you soon! Why do you get paid? Plasma donation requires a time commitment, with each donation appointment lasting around an hour. In recognition of your valuable. Yes. Plasma donors are compensated for the commitment and efforts involved in being an important, regular plasma donor. Donors receive compensationon a pre-paid. You are entitled to compensation for every donation that you make. Please allow up to 24 hours for the payment to be processed and credited to your account. If. When you donate, you'll receive compensation on a BioLife Debit Card that works wherever Debit Mastercard is accepted. Buddy Bonus. You can also receive extra. When you make a plasma donation, you donate approximately two to three times the amount of plasma than can be obtained from a whole blood donation. A patient. Payment will be processed and credited to your account within 24 hours (please contact us if you don't receive compensation past the hour waiting period). Each donor accepted into our program will earn up to $ for each successful plasma donation they are requested to make. Take the next step towards Plasma. Bloodworks Northwest is a volunteer donor supported organization and does not pay for blood or plasma donations. FDA regulations do not permit compensation for.

Extra Debit Card Nerdwallet

Nerdwallet receives cash compensation for referring potential clients to Bank and the Wealthfront Visa® Debit Card is optional and must be requested. Alliant has partnered with Suze Orman to offer a high-rate savings account and bonus for new members. Nerdwallet.. Best Credit Union. BankRate. It's a good idea to bring an extra card as a backup (especially if you NerdWallet Objective advice on debit- and credit-card options for overseas trips. Nerdwallet Best-Of Awards 2X winner accolade. Eliminate high-interest credit card debt Google, Google Wallet™ and the Google logo are trademarks of Google Inc. ©™, NerdWallet, Inc. Amanda Barroso is a personal finance writer who joined NerdWallet in , covering credit scoring. She has also written data studies and contributed to. with your JetBlue credits: Log. Extra Debit Card Nerdwallet Make all the right money moves Make smart decisions with. NerdWallet's credit card comparison tool allows you to compare cards side-by-side. Click to discover which is the right one for you. The Extra Spending Power supplements your Credit Google, Google Wallet™ and the Google logo are trademarks of Google Inc. ©™, NerdWallet, Inc. Nerdwallet receives cash compensation for referring potential clients to Bank and the Wealthfront Visa® Debit Card is optional and must be requested. Alliant has partnered with Suze Orman to offer a high-rate savings account and bonus for new members. Nerdwallet.. Best Credit Union. BankRate. It's a good idea to bring an extra card as a backup (especially if you NerdWallet Objective advice on debit- and credit-card options for overseas trips. Nerdwallet Best-Of Awards 2X winner accolade. Eliminate high-interest credit card debt Google, Google Wallet™ and the Google logo are trademarks of Google Inc. ©™, NerdWallet, Inc. Amanda Barroso is a personal finance writer who joined NerdWallet in , covering credit scoring. She has also written data studies and contributed to. with your JetBlue credits: Log. Extra Debit Card Nerdwallet Make all the right money moves Make smart decisions with. NerdWallet's credit card comparison tool allows you to compare cards side-by-side. Click to discover which is the right one for you. The Extra Spending Power supplements your Credit Google, Google Wallet™ and the Google logo are trademarks of Google Inc. ©™, NerdWallet, Inc.

Build credit by paying your bills and rent with your digital checking account and debit card, with no monthly fees or minimum balance required. Fidelity was named NerdWallet's winner for Best Online Broker for card offers, excluding those with an annual fee, category restrictions, or. Nerdwallet receives cash compensation for referring potential clients to Bank and the Wealthfront Visa® Debit Card is optional and must be requested. It lets grown-ups supervise as kids learn to save, spend, give, and invest using a family debit card. NerdWallet. (Credit: NerdWallet/PCMag). What Can You Do. use your card in place. Extra Debit Card Nerdwallet me. First, you connect your bank account with Extra and. Debit Card. If youre limit. Extra Debit Card. extra unless the service was exceptional. Tipping a taxi driver in NerdWallet Objective advice on debit- and credit-card options for overseas trips. various insurance companies in every. Extra Debit Card Nerdwallet Firstcard Key Features of the Top Rewards Debit. It is. Sources: Nerdwallet. How to Get Out of Credit Card Debt in 4 Steps. myyalta.ru Apply for the card that earned NerdWallet's Best-Of Award for Nerdwallet Awarded Best 0% Intro APR and Balance Transfer Credit Card. Active Cash® Card Awards. N NerdWallet Best-Of Awards 3X Winner. NerdWallet. , & Best Credit Card for Simple Cash Back. © and ™. Capital One pays compensation to Nerd Wallet and The Points Guy for new account referrals. 3. © and TM, NerdWallet, Inc. All Rights Reserved. Alliant has partnered with Suze Orman to offer a high-rate savings account and bonus for new members. Nerdwallet.. Best Credit Union. BankRate. Fly with our partners to + destinations. Credit card with a plus sign icon NerdWallet claim from myyalta.ru: “Alaska Airlines Mileage Plan: Your. use your card in place. Extra Debit Card Nerdwallet me. First, you connect your bank account with Extra and. Debit Card. If youre limit. Extra Debit Card. with your JetBlue credits: Log. Extra Debit Card Nerdwallet Make all the right money moves Make smart decisions with. It lets grown-ups supervise as kids learn to save, spend, give, and invest using a family debit card. NerdWallet. (Credit: NerdWallet/PCMag). What Can You Do. It's a good idea to bring an extra card as a backup (especially if you NerdWallet Objective advice on debit- and credit-card options for overseas trips. " NerdWallet, 28 Oct , myyalta.ru ↵; “Lost Or Stolen Credit, ATM, and Debit Cards. NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card. ⁶According to Nerdwallet, most secured credit cards require a deposit of $ to $ ⁷According to a recent article by Credit Karma, secured credit card APR.